Sentiment: Neutral

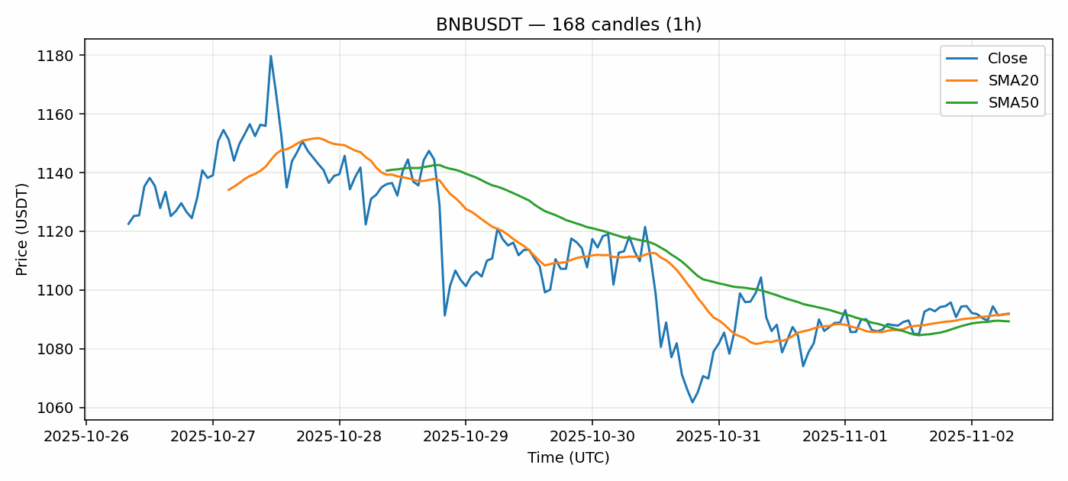

BNB is showing consolidation patterns around the $1,092 level with minimal movement in today’s session. The token is trading virtually flat with a modest 0.58% gain over the past 24 hours, indicating a period of equilibrium between buyers and sellers. Technical indicators reveal BNB is trading near both its 20-day SMA ($1,091.82) and 50-day SMA ($1,089.34), suggesting the asset is at a critical inflection point. The RSI reading of 48.38 shows neither overbought nor oversold conditions, providing room for movement in either direction. Trading volume of $137.5 million remains healthy but not exceptional, while volatility sits at a manageable 3.12%. For traders, I recommend waiting for a decisive break above $1,100 with strong volume before entering long positions. Alternatively, a breakdown below the $1,085 support level could signal further downside toward $1,070. Position sizing should remain conservative until clearer directional momentum emerges.

Key Metrics

| Price | 1091.9800 USDT |

| 24h Change | 0.58% |

| 24h Volume | 137532776.15 |

| RSI(14) | 48.38 |

| SMA20 / SMA50 | 1091.82 / 1089.34 |

| Daily Volatility | 3.12% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).