Sentiment: Neutral

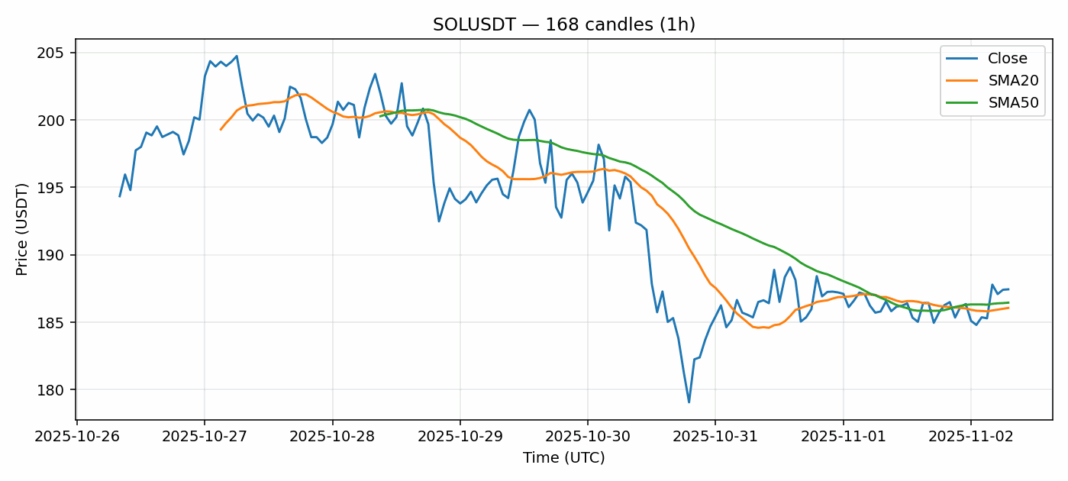

SOL is showing resilience at the $187 level, trading just above its 20-day SMA of $186.06 while testing the 50-day SMA resistance at $186.45. The 0.9% 24-hour gain on substantial $276M volume indicates healthy accumulation, though the RSI at 63 suggests we’re approaching overbought territory. Current volatility of 3.87% reflects typical SOL market conditions. Traders should watch for a decisive break above $190 with volume confirmation for bullish continuation, while failure to hold $185 could trigger a retest of $180 support. The tight consolidation between moving averages suggests an imminent directional move – position sizing should reflect this uncertainty. Consider scaling into longs above $190 with stops below $184, or short positions if we lose the 20-day SMA with conviction.

Key Metrics

| Price | 187.4400 USDT |

| 24h Change | 0.92% |

| 24h Volume | 276313298.19 |

| RSI(14) | 63.16 |

| SMA20 / SMA50 | 186.06 / 186.45 |

| Daily Volatility | 3.87% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).