Sentiment: Bullish

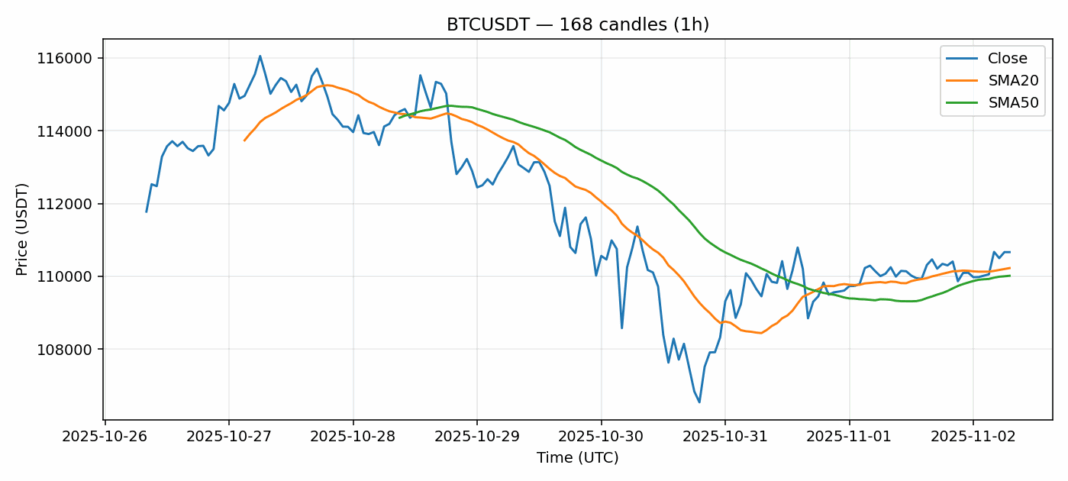

Bitcoin continues to show resilience above the $110,000 level, trading at $110,663 with a modest 0.6% gain over the past 24 hours. The current price sits comfortably above both the 20-day SMA ($110,225) and 50-day SMA ($110,015), indicating underlying bullish momentum. The RSI reading of 60 suggests Bitcoin is approaching overbought territory but still has room for upward movement before hitting extreme levels. Trading volume remains robust at over $1 billion, signaling sustained institutional and retail interest. The 2.2% volatility indicates relatively stable price action compared to Bitcoin’s historical norms. For traders, maintaining long positions with tight stop-losses below $109,500 appears prudent, while new entries might consider waiting for a pullback toward the $109,800-$110,200 support zone. The consolidation above key moving averages suggests accumulation is occurring, potentially setting the stage for another leg higher if volume persists.

Key Metrics

| Price | 110663.9000 USDT |

| 24h Change | 0.60% |

| 24h Volume | 1038907858.81 |

| RSI(14) | 60.26 |

| SMA20 / SMA50 | 110224.98 / 110014.62 |

| Daily Volatility | 2.21% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).