Sentiment: Bearish

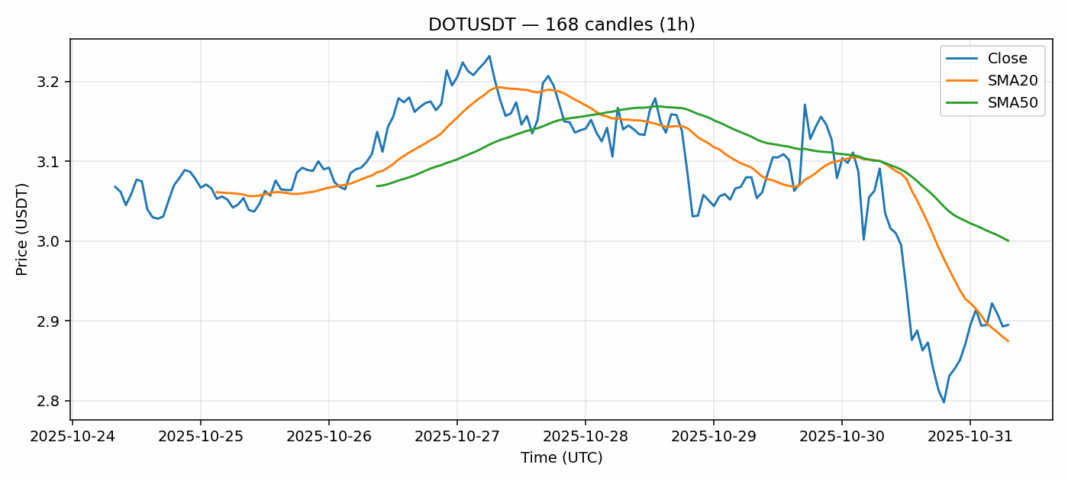

DOT is showing concerning weakness after a 5.4% decline to $2.895, though it’s holding just above the 20-day SMA at $2.875. The current price sitting between the 20-day support and 50-day resistance at $3.00 suggests consolidation, but the breakdown below the psychologically important $3.00 level raises red flags. RSI at 61.6 indicates DOT isn’t oversold yet, leaving room for further downside. Trading volume of $29.4 million shows decent participation in the move lower. Traders should watch the $2.87 level closely – a decisive break below could trigger additional selling toward $2.75. For now, I’d recommend waiting for either a reclaim of $3.00 with volume or a clear breakdown below $2.87 before taking new positions. Risk management is crucial given the elevated volatility reading of 3.63%. Consider scaling into positions rather than going all-in given the current uncertainty.

Key Metrics

| Price | 2.8950 USDT |

| 24h Change | -5.42% |

| 24h Volume | 29453932.80 |

| RSI(14) | 61.60 |

| SMA20 / SMA50 | 2.88 / 3.00 |

| Daily Volatility | 3.63% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).