Sentiment: Bearish

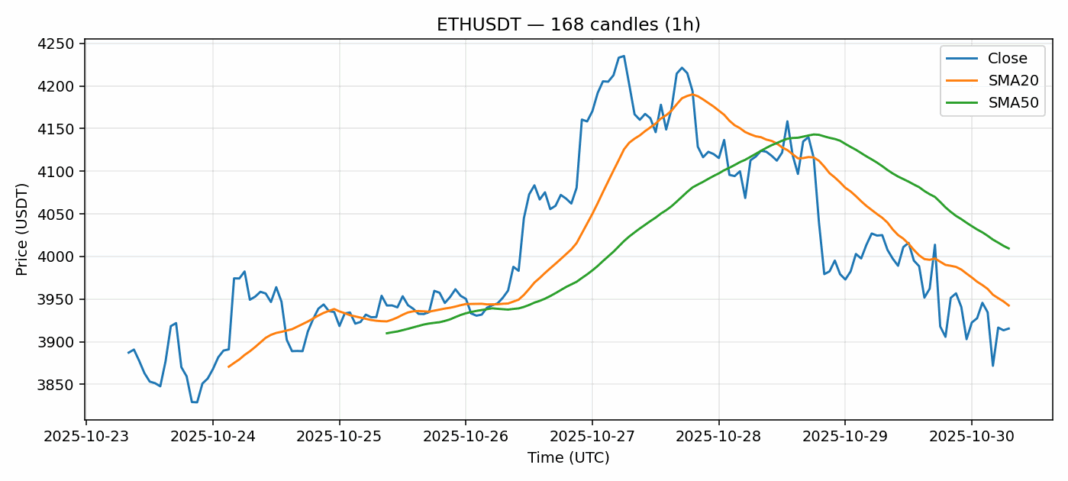

Ethereum continues to face selling pressure, with ETH/USDT declining 2.69% over the past 24 hours to trade at $3,915. The technical picture reveals concerning signals as ETH trades below both its 20-day SMA ($3,942) and 50-day SMA ($4,009), indicating sustained bearish momentum. The RSI reading of 37 suggests ETH is approaching oversold territory but hasn’t reached extreme levels yet. Trading volume remains robust at over $2.18 billion, suggesting active participation in the current downtrend. The elevated volatility of nearly 3% indicates significant price swings are likely to continue. For traders, current levels might present accumulation opportunities for those with longer time horizons, though strict risk management is advised. Consider scaling into positions with stops below $3,850, targeting a rebound toward the $4,000 resistance zone. Short-term traders should wait for RSI confirmation of oversold conditions before entering long positions.

Key Metrics

| Price | 3915.4300 USDT |

| 24h Change | -2.69% |

| 24h Volume | 2182405449.04 |

| RSI(14) | 37.04 |

| SMA20 / SMA50 | 3942.53 / 4009.44 |

| Daily Volatility | 2.95% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).