Sentiment: Neutral

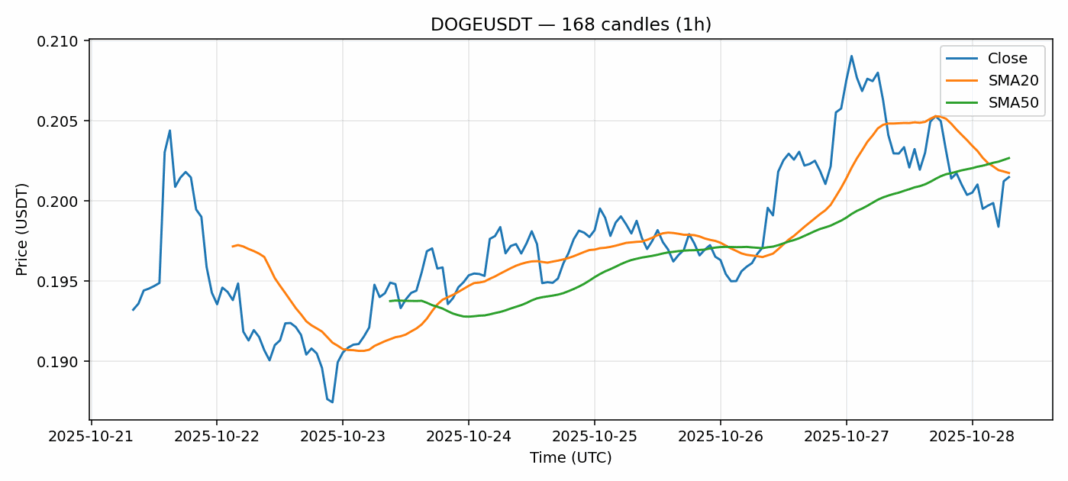

DOGE is showing signs of potential exhaustion in its current downtrend, trading at $0.20149 with a 2.99% decline over the past 24 hours. The RSI reading of 34.99 indicates the meme coin is approaching oversold territory, which often precedes a technical bounce. Volume remains substantial at $183 million, suggesting continued trader interest despite the price weakness. DOGE currently trades slightly below both its 20-day SMA ($0.20175) and 50-day SMA ($0.20268), indicating short-term bearish momentum but with key moving averages converging nearby. The 3.09% volatility reading suggests relatively stable conditions for DOGE. Traders should watch for a potential reversal if DOGE can reclaim the $0.202 level with conviction. Consider scaling into long positions on any dips toward $0.195-0.198 support, with stops below $0.193. Resistance awaits at $0.205 and $0.208 levels.

Key Metrics

| Price | 0.2015 USDT |

| 24h Change | -2.98% |

| 24h Volume | 183273188.04 |

| RSI(14) | 34.99 |

| SMA20 / SMA50 | 0.20 / 0.20 |

| Daily Volatility | 3.09% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).