Sentiment: Neutral

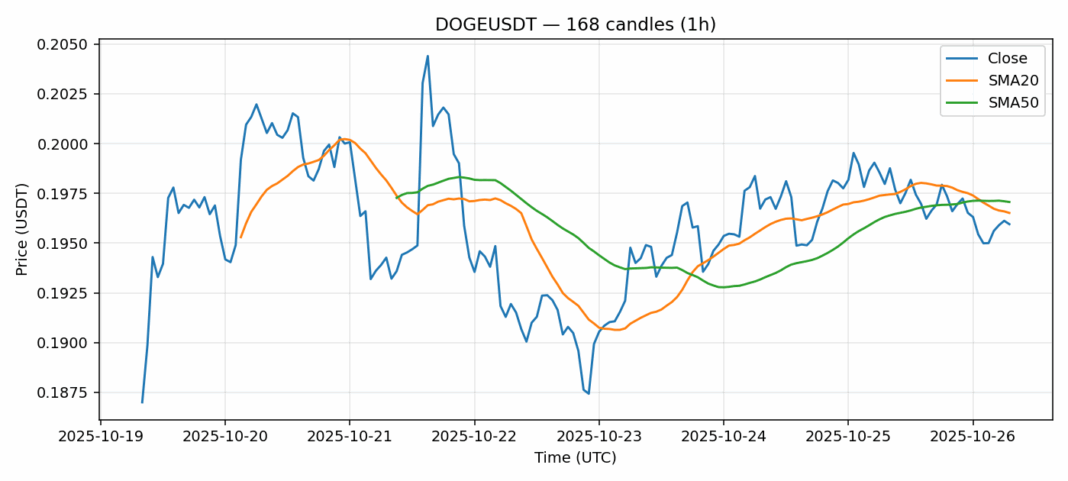

DOGE is showing consolidation patterns after a modest 1.26% decline over the past 24 hours, currently trading at $0.196. The meme coin finds itself at a critical technical juncture, with price hovering just below both the 20-day SMA ($0.197) and 50-day SMA ($0.197), suggesting potential resistance overhead. The RSI reading of 42.4 indicates neither overbought nor oversold conditions, leaving room for movement in either direction. Trading volume remains healthy at over $81 million, though volatility has moderated to 3.28%. For traders, the current setup suggests waiting for a decisive break above the $0.197 resistance cluster or a drop below $0.195 for directional clarity. Position sizing should remain conservative given DOGE’s meme coin status and inherent volatility. Consider scaling into positions on confirmed breakouts with tight stop-losses given the compressed trading range.

Key Metrics

| Price | 0.1960 USDT |

| 24h Change | -1.25% |

| 24h Volume | 81214337.80 |

| RSI(14) | 42.40 |

| SMA20 / SMA50 | 0.20 / 0.20 |

| Daily Volatility | 3.28% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).