Sentiment: Bullish

BNB is showing resilience above the $1,120 level with modest 0.58% gains over the past 24 hours. The current price trading above both the 20-day SMA ($1,116.50) and 50-day SMA ($1,115.80) indicates underlying strength, though the RSI reading of 65.69 suggests we’re approaching overbought territory. Trading volume of $173 million provides adequate liquidity, while volatility remains manageable at 3.32%. The convergence of moving averages around current price levels creates a critical support zone. Traders should watch for sustained closes above $1,125 for potential continuation toward $1,150 resistance. However, failure to hold $1,115 could trigger a pullback toward $1,100 support. Consider scaling into positions on dips toward the SMA cluster with tight stops below $1,110. The current setup favors cautious optimism but requires disciplined risk management given the elevated RSI.

Key Metrics

| Price | 1121.4200 USDT |

| 24h Change | 0.58% |

| 24h Volume | 173565547.57 |

| RSI(14) | 65.69 |

| SMA20 / SMA50 | 1116.50 / 1115.80 |

| Daily Volatility | 3.32% |

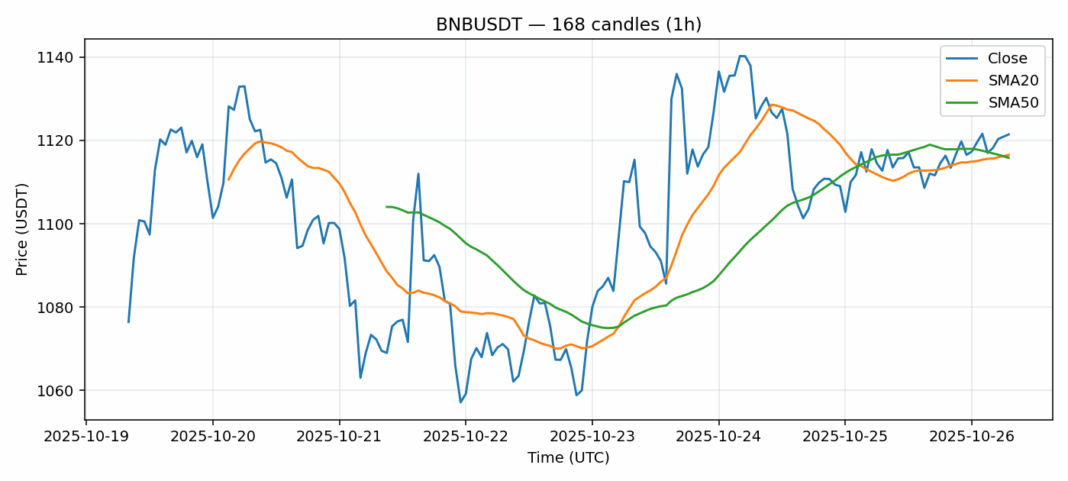

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).