Sentiment: Neutral

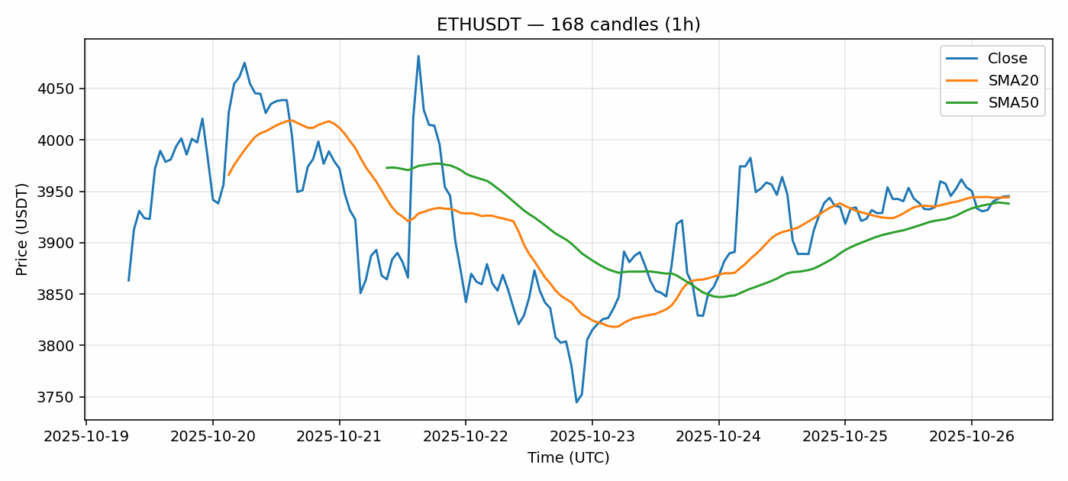

Ethereum continues to consolidate around the $3,945 level, showing remarkable stability despite broader market uncertainty. The 0.41% gain over the past 24 hours, while modest, demonstrates resilience as ETH trades just above both its 20-day ($3,944.19) and 50-day ($3,938.02) simple moving averages. This technical positioning suggests strong underlying support, with the RSI reading of 55 indicating neither overbought nor oversold conditions. Trading volume approaching $547 million shows healthy participation, though the 3.1% volatility reading suggests traders should expect continued range-bound action. For active traders, consider accumulating on dips toward the $3,900 support zone with stops below $3,850. The current setup favors range trading strategies until we see a decisive break above $4,000 or below $3,880. Longer-term holders might view any weakness as accumulation opportunities, given Ethereum’s strong fundamentals and upcoming network developments.

Key Metrics

| Price | 3945.2300 USDT |

| 24h Change | 0.41% |

| 24h Volume | 546878945.37 |

| RSI(14) | 55.23 |

| SMA20 / SMA50 | 3944.19 / 3938.02 |

| Daily Volatility | 3.10% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).