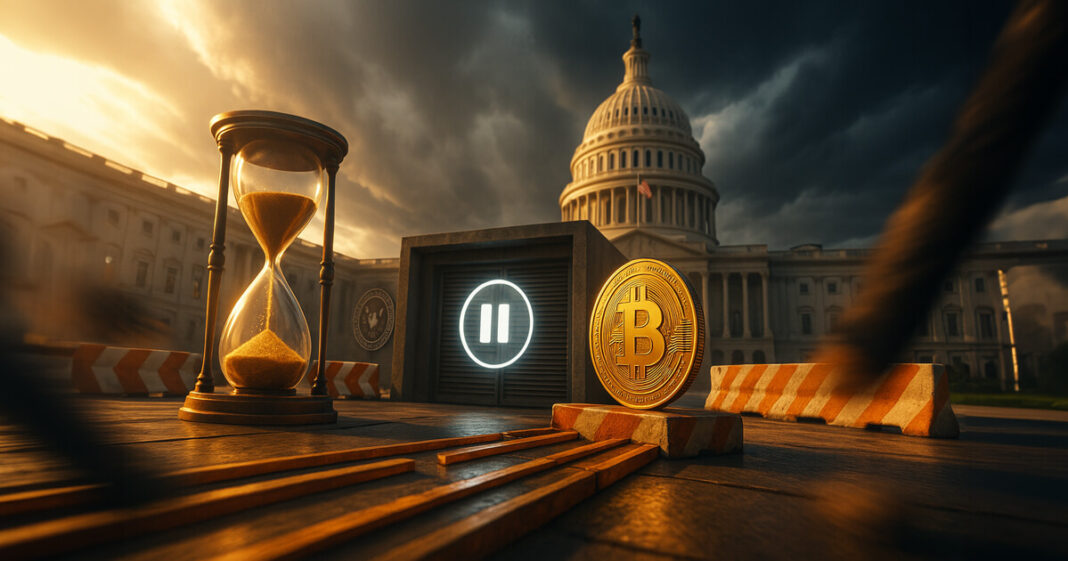

The October 2025 U.S. federal government shutdown created significant operational challenges for financial regulators, with the Securities and Exchange Commission implementing contingency staffing protocols. This development directly impacted the digital asset sector, leaving approximately one hundred cryptocurrency exchange-traded fund applications in regulatory limbo without definitive approval timelines.

Concurrently, the suspension of critical economic data releases from key agencies including the Bureau of Labor Statistics and the U.S. Census Bureau created additional market uncertainty. These economic indicators typically provide essential guidance for institutional and retail investors navigating volatile market conditions.

Despite these regulatory and informational headwinds, cryptocurrency markets demonstrated notable stability throughout the shutdown period. Market participants maintained trading activity while adapting to the temporary absence of both regulatory clarity and traditional economic benchmarks. This episode highlighted the digital asset ecosystem’s capacity to function independently during traditional financial system disruptions.

The situation underscored the cryptocurrency market’s evolving maturity and its ability to withstand external political and operational pressures. Market infrastructure continued operating effectively despite the temporary vacuum in federal oversight and economic reporting, suggesting increased institutionalization and self-sufficiency within digital asset markets.