Sentiment: Bullish

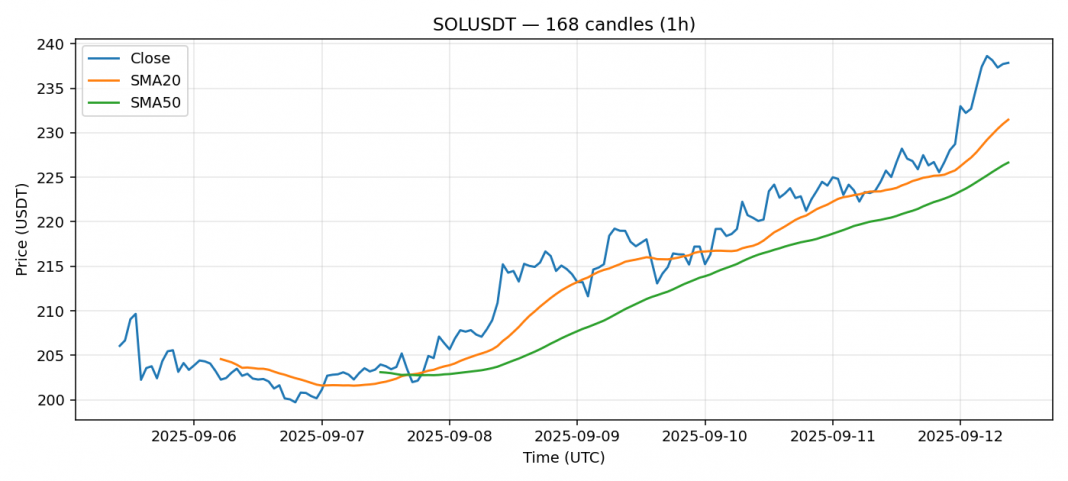

SOL is showing strong bullish momentum, trading at $237.85 with a notable 6.21% gain over the past 24 hours. The RSI reading of 81.77 indicates the asset is significantly overbought, suggesting potential for a near-term pullback. However, the price remains well above both the 20-day SMA ($231.48) and 50-day SMA ($226.65), confirming the uptrend’s strength. The high volatility of 3.07% combined with substantial volume of $1.38B reflects active institutional interest. Traders should consider taking partial profits here while maintaining core positions, with key support at the $230 level. A break below $225 would signal trend weakness. For new entries, wait for a pullback to the $220-225 zone for better risk-reward ratios.

Key Metrics

| Price | 237.8500 USDT |

| 24h Change | 6.21% |

| 24h Volume | 1377997958.55 |

| RSI(14) | 81.77 |

| SMA20 / SMA50 | 231.48 / 226.65 |

| Daily Volatility | 3.07% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).