Sentiment: Bullish

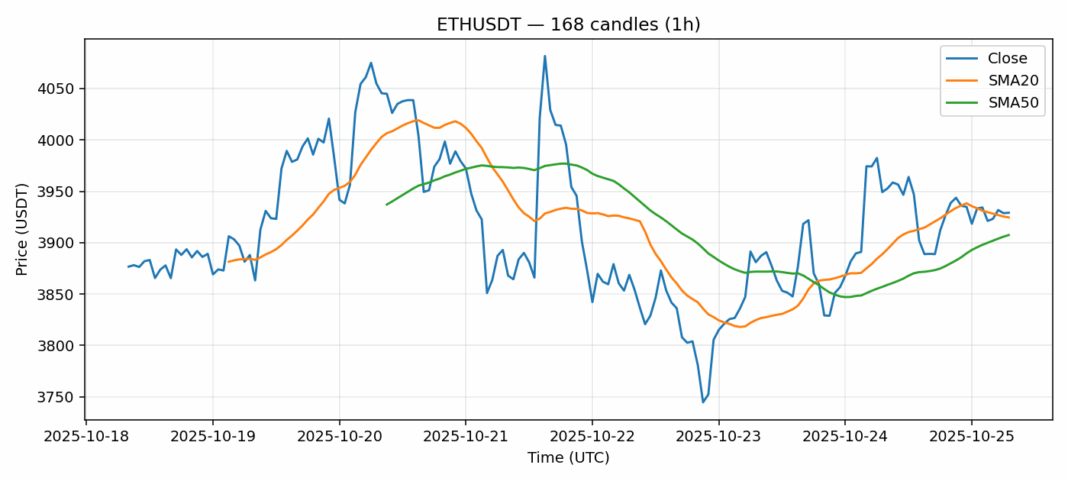

Ethereum continues to trade in a tight consolidation pattern around the $3,930 level, showing resilience despite a modest 1.36% pullback over the past 24 hours. The current price action finds ETH hovering just above both its 20-day SMA ($3,924.60) and 50-day SMA ($3,907.46), indicating underlying strength in the medium-term trend. The RSI reading of 66.33 suggests ETH is approaching overbought territory but hasn’t yet reached extreme levels that would signal an imminent reversal. Trading volume remains robust at $1.44 billion, supporting the current price structure. For traders, the key levels to watch are the $3,900 support zone and the psychological $4,000 resistance. A decisive break above $4,000 could trigger momentum buying toward $4,200, while a breakdown below $3,850 would suggest deeper correction potential. Consider scaling into positions on dips toward the $3,880-$3,900 support cluster with tight stop-losses.

Key Metrics

| Price | 3929.1400 USDT |

| 24h Change | -1.36% |

| 24h Volume | 1441141848.87 |

| RSI(14) | 66.33 |

| SMA20 / SMA50 | 3924.60 / 3907.46 |

| Daily Volatility | 3.13% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).