Sentiment: Neutral

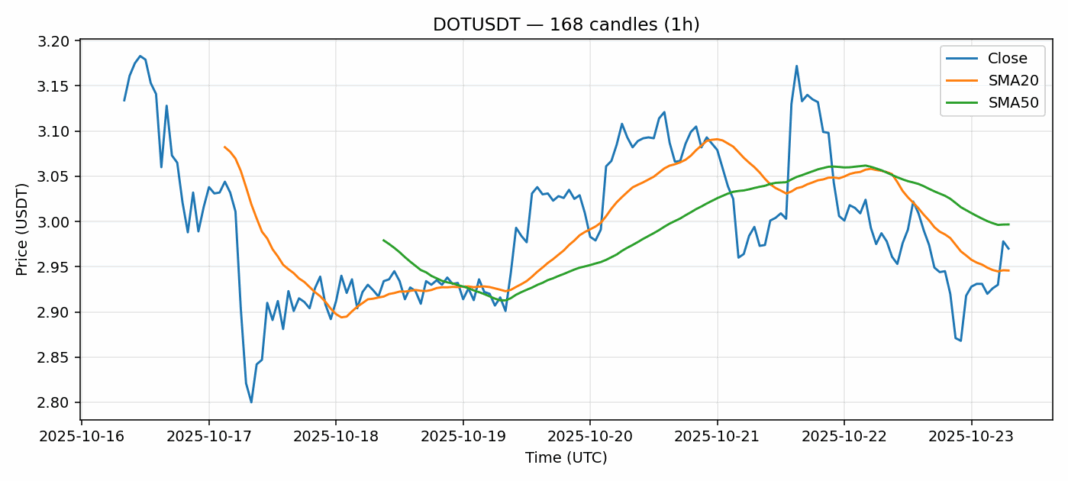

DOT is showing consolidation around the $2.97 level after a modest 1.13% decline over the past 24 hours. The current technical picture reveals mixed signals – while the RSI at 54.7 sits in neutral territory, the price has managed to hold above the 20-day SMA at $2.94, indicating some underlying support. However, the 50-day SMA at $2.99 is acting as immediate resistance. Trading volume of $23.4 million suggests moderate participation, though the 4.52% volatility reading indicates potential for larger moves. For traders, the key levels to watch are the $2.94 support and $2.99 resistance break. A sustained move above $3.00 could trigger momentum buying toward $3.15, while failure to hold $2.90 might see a test of $2.80. Consider scaling into positions with tight stops given the current volatility environment.

Key Metrics

| Price | 2.9700 USDT |

| 24h Change | -0.03% |

| 24h Volume | 23431684.33 |

| RSI(14) | 54.71 |

| SMA20 / SMA50 | 2.95 / 3.00 |

| Daily Volatility | 4.52% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).