Sentiment: Neutral

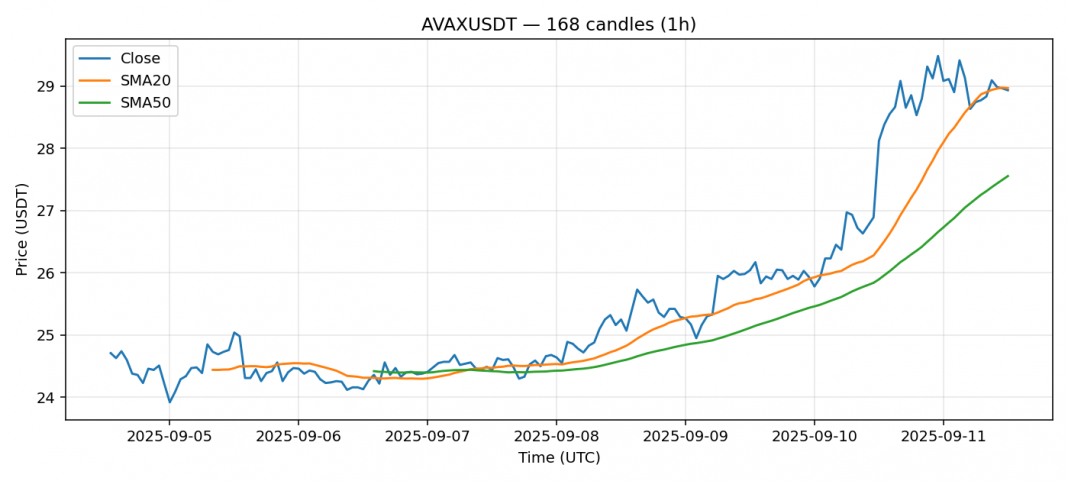

AVAX is showing mixed signals at $28.93, with a notable 4.9% gain over the past 24 hours. The RSI at 46.7 indicates neutral momentum, neither overbought nor oversold, suggesting room for movement in either direction. Price is currently trading just below the 20-day SMA ($28.97), indicating slight short-term bearish pressure, but remains above the 50-day SMA ($27.55), which provides a solid support level. The 24-hour volume of $228M is healthy, showing decent trader interest. Given the current volatility of 3.89%, I expect continued range-bound trading between $27.50 and $30. Traders might consider accumulating near the $27.50 support with a stop loss below $26.50, targeting a breakout above $30 for a move toward $32.

Key Metrics

| Price | 28.9300 USDT |

| 24h Change | 4.89% |

| 24h Volume | 228006379.43 |

| RSI(14) | 46.74 |

| SMA20 / SMA50 | 28.97 / 27.55 |

| Daily Volatility | 3.89% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).