As cryptocurrency adoption accelerates globally, establishing a comprehensive inheritance strategy for digital assets has become increasingly crucial. Without proper planning, substantial Bitcoin holdings risk becoming permanently inaccessible to intended beneficiaries. The decentralized nature of blockchain technology means traditional estate planning mechanisms often fail to address the unique requirements of cryptocurrency wealth transfer.

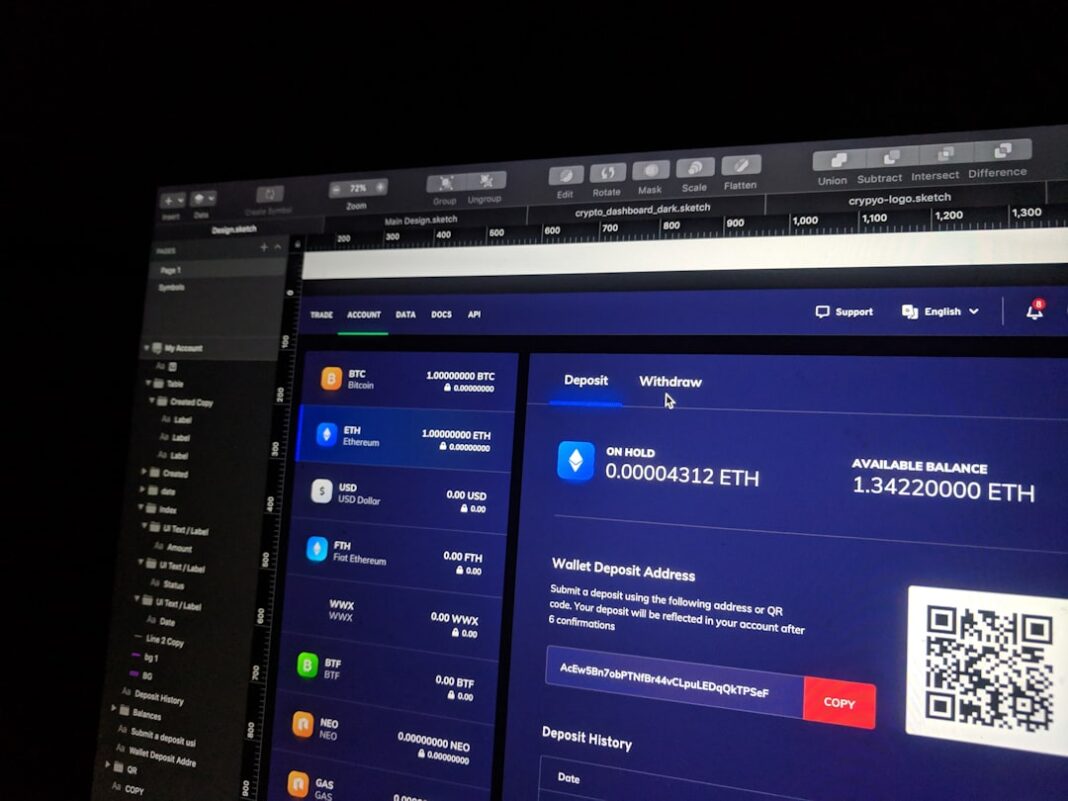

Effective crypto inheritance planning requires systematic approaches to key management and access protocols. Investors should implement secure methods for storing private keys and seed phrases while ensuring trusted parties can access them under predetermined conditions. Multi-signature wallets, hardware storage solutions with inheritance features, and encrypted digital instructions provide practical frameworks for safeguarding digital wealth.

Beyond technical considerations, legal documentation must explicitly reference digital assets and provide clear authorization for executors to manage cryptocurrency holdings. Professional guidance from attorneys familiar with digital asset law can help navigate jurisdictional complexities and ensure compliance with evolving regulations.

Regularly updating inheritance plans to reflect portfolio changes and technological developments remains fundamental to maintaining effective protection. Establishing these protocols today prevents potential loss of significant value and ensures smooth transition of digital wealth to future generations.