Sentiment: Bullish

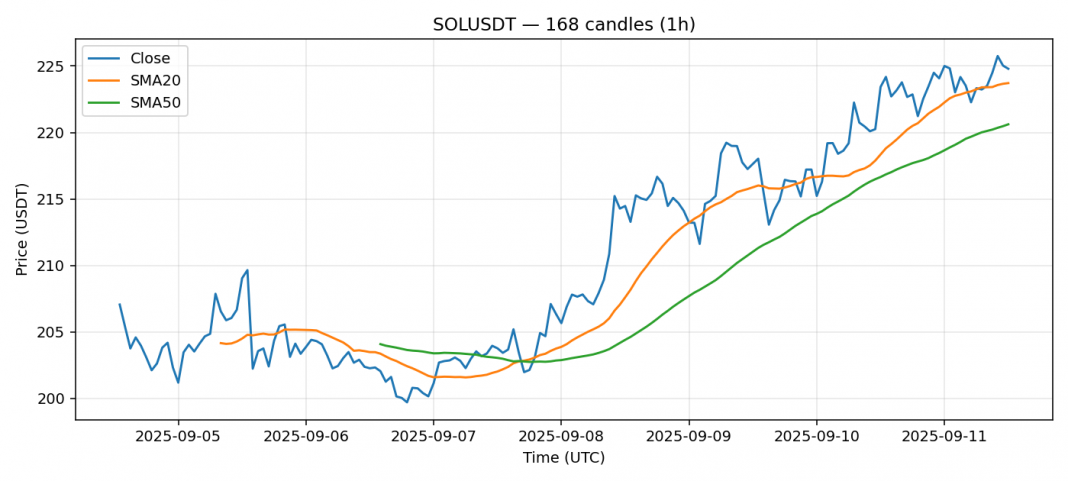

SOL is currently trading at $224.83, showing modest strength with a 0.46% gain over the past 24 hours. The price is hovering just above the 20-day SMA at $223.71 and remains above the 50-day SMA at $220.61, indicating underlying bullish momentum. The RSI reading of 51.36 is neutral, suggesting neither overbought nor oversold conditions. Volume remains robust at over $951 million, supporting current price levels. Given the tight consolidation near key moving averages, I expect a potential breakout. Traders should watch for a decisive move above $226 for long entries, with stops below $220. The low volatility environment suggests limited downside risk, making this an attractive accumulation zone for swing traders targeting $235-240.

Key Metrics

| Price | 224.8300 USDT |

| 24h Change | 0.46% |

| 24h Volume | 951141175.97 |

| RSI(14) | 51.36 |

| SMA20 / SMA50 | 223.71 / 220.61 |

| Daily Volatility | 3.05% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).