Sentiment: Neutral

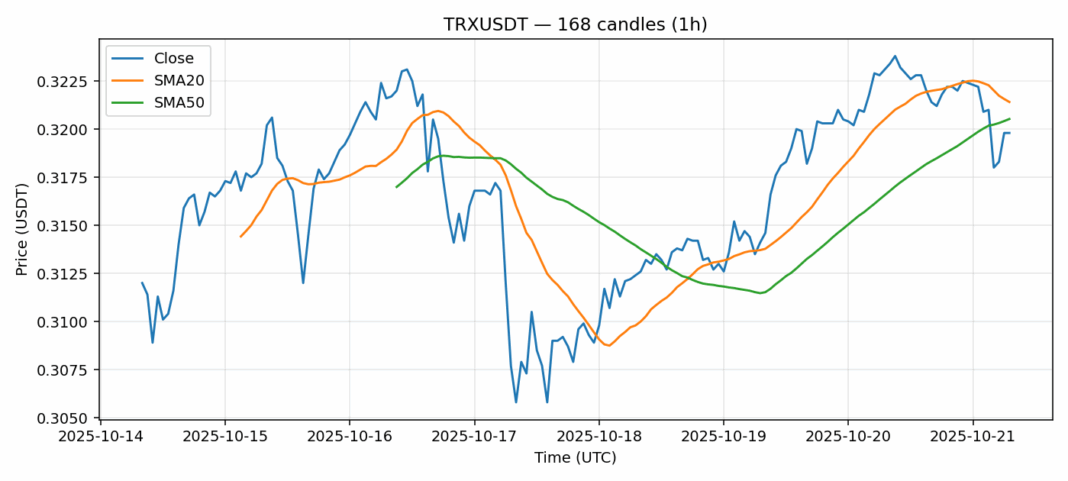

TRX/USDT is showing signs of consolidation after recent selling pressure, currently trading at $0.3198 with a modest 0.87% decline over the past 24 hours. The RSI reading of 41.46 indicates the asset is approaching oversold territory but hasn’t yet reached extreme levels, suggesting there might be room for further downside. Trading volume of $67.3 million remains healthy, providing adequate liquidity for both entry and exit positions. The price currently sits just below both the 20-day SMA ($0.32141) and 50-day SMA ($0.320526), indicating short-term bearish momentum. However, the proximity to these key moving averages suggests potential for a breakout in either direction. Traders should watch for a decisive break above $0.322 for bullish confirmation, while a drop below $0.315 could signal further downside. Given the current technical setup, scaling into positions with tight stop losses appears prudent rather than aggressive positioning.

Key Metrics

| Price | 0.3198 USDT |

| 24h Change | -0.87% |

| 24h Volume | 67378123.48 |

| RSI(14) | 41.46 |

| SMA20 / SMA50 | 0.32 / 0.32 |

| Daily Volatility | 1.93% |

TRON — 1h candles, 7D window (SMA20/SMA50, RSI).