Leading Bitcoin mining enterprises witnessed significant stock appreciation on Monday, with CleanSpark spearheading the sector-wide surge. Market analysts observed robust trading activity across multiple mining corporations as institutional investors demonstrated renewed confidence in the industry’s evolving business models.

The upward trajectory reflects growing market optimism about mining companies’ strategic expansion into complementary technological sectors. Several firms have begun allocating portions of their substantial computational resources toward emerging high-performance computing applications, creating diversified revenue streams beyond cryptocurrency validation.

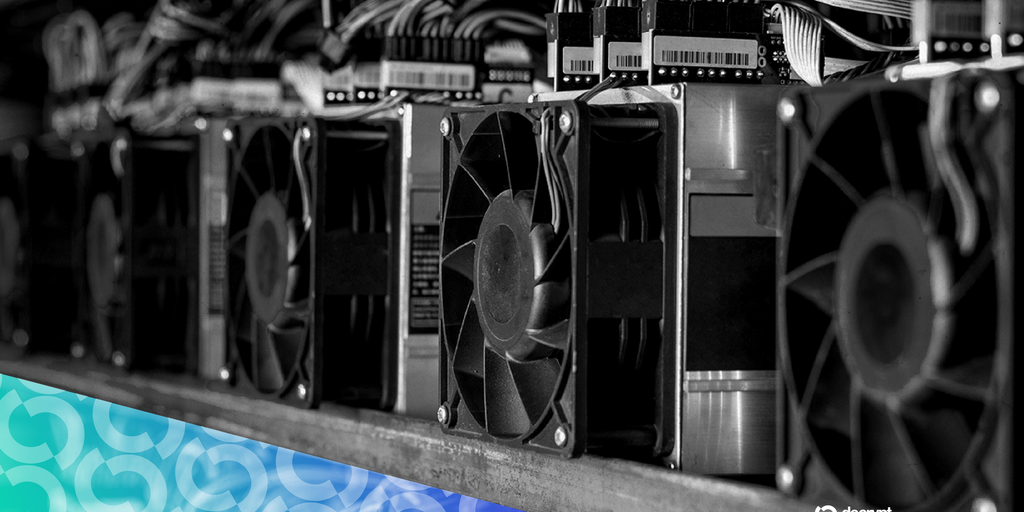

Industry observers note that this strategic pivot leverages existing infrastructure investments while positioning companies to capitalize on growing demand for intensive computational processing. The transition represents a natural evolution for mining operations that already maintain sophisticated data center operations and power management systems.

CleanSpark’s performance particularly stood out during Monday’s trading session, though multiple mining stocks demonstrated strong momentum. The sector’s collective gains suggest investors are recognizing the long-term value proposition of mining companies that successfully adapt to changing market conditions while maintaining their core Bitcoin operations.

This market movement coincides with increasing institutional adoption of cryptocurrency and evolving regulatory frameworks that provide greater clarity for digital asset enterprises. Mining companies appear well-positioned to benefit from both the maturation of cryptocurrency markets and new opportunities in adjacent technology sectors.