Sentiment: Bullish

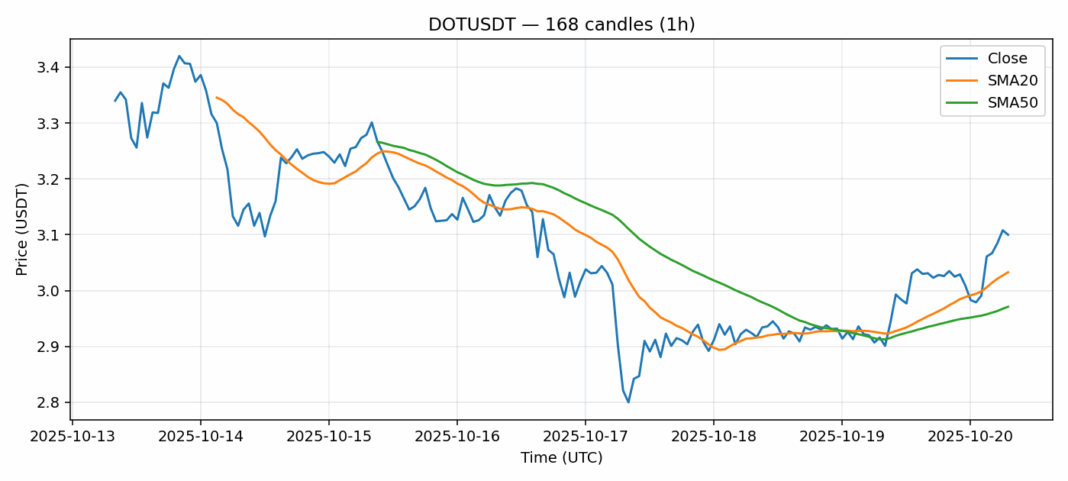

DOT is showing strong momentum with a 6.68% surge over the past 24 hours, pushing the price to $3.10 against USDT. The current RSI reading of 67.74 indicates approaching overbought territory but hasn’t crossed the critical 70 threshold yet. Technical positioning remains favorable with price trading above both the 20-day SMA ($3.03) and 50-day SMA ($2.97), confirming the bullish trend structure. Volume has been robust at over $21 million, suggesting genuine institutional interest rather than retail speculation. However, traders should exercise caution given the elevated volatility reading of 4.64%. For active positions, consider taking partial profits near the $3.15-3.20 resistance zone while maintaining core holdings. New entries might wait for a pullback to the $3.00-3.05 support area for better risk-reward positioning. The overall structure suggests DOT could test higher levels if Bitcoin stability persists.

Key Metrics

| Price | 3.1000 USDT |

| 24h Change | 6.68% |

| 24h Volume | 21242489.93 |

| RSI(14) | 67.74 |

| SMA20 / SMA50 | 3.03 / 2.97 |

| Daily Volatility | 4.64% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).