Sentiment: Bullish

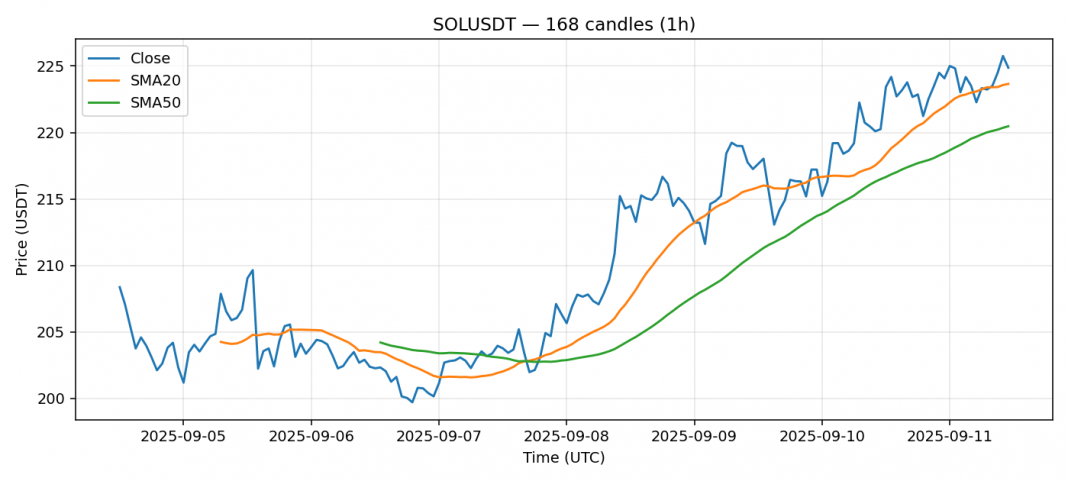

SOL is showing resilience, trading at $224.88 with a modest 2.47% gain over the past 24 hours. The price is hovering just above the 20-day SMA at $223.65, indicating near-term support, while remaining well above the 50-day SMA at $220.47, which is a positive medium-term signal. The RSI at 55.85 is in neutral territory, suggesting there’s room for movement in either direction without immediate overbought or oversold concerns. Volume is healthy at nearly $900 million, showing decent participation. Given the current technical setup, I’d advise watching for a decisive break above $225 to confirm upward momentum targeting $230-$235. A drop below the 20-day SMA could see a test of $220 support. Consider setting tight stop-losses around $222 if long, as volatility remains elevated at 3.07%.

Key Metrics

| Price | 224.8800 USDT |

| 24h Change | 2.47% |

| 24h Volume | 896595892.08 |

| RSI(14) | 55.85 |

| SMA20 / SMA50 | 223.65 / 220.47 |

| Daily Volatility | 3.07% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).