Sentiment: Bearish

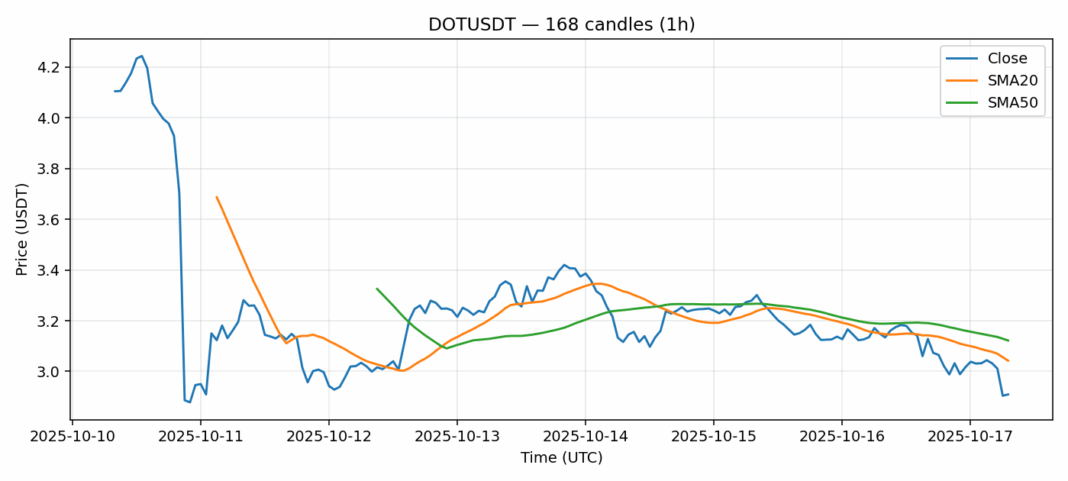

DOT is showing significant technical weakness after an 8.2% decline over the past 24 hours, with price currently trading at $2.908. The RSI reading of 28.75 indicates the asset is deeply oversold, suggesting potential for a near-term bounce. However, DOT remains below both the 20-day SMA ($3.042) and 50-day SMA ($3.122), confirming the bearish momentum structure. Volume remains elevated at $38.9 million, indicating strong institutional interest despite the price decline. The high volatility reading of 11.57% suggests traders should expect continued price swings. For active traders, consider scaling into long positions between $2.85-$2.95 with tight stop losses, targeting a retest of the $3.10 resistance level. Position traders should wait for a confirmed break above the 20-day SMA before establishing larger positions. Risk management remains crucial given the elevated volatility environment.

Key Metrics

| Price | 2.9080 USDT |

| 24h Change | -8.21% |

| 24h Volume | 38954375.02 |

| RSI(14) | 28.76 |

| SMA20 / SMA50 | 3.04 / 3.12 |

| Daily Volatility | 11.57% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).