Sentiment: Bearish

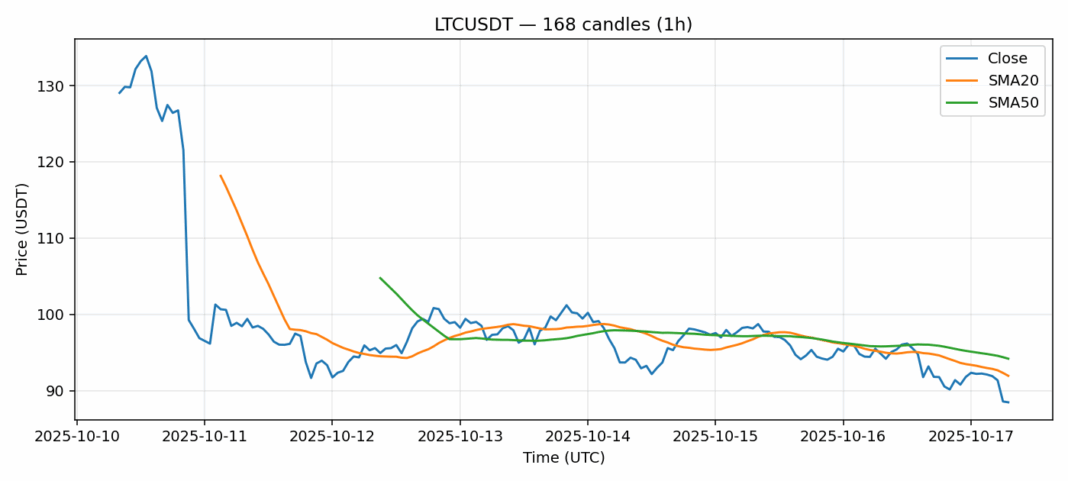

Litecoin faces significant selling pressure as LTCUSDT trades at $88.47, down 7.41% over the past 24 hours. The current price sits below both the 20-day SMA ($91.95) and 50-day SMA ($94.19), indicating sustained bearish momentum. However, the RSI reading of 31.4 suggests LTC is approaching oversold territory, which could signal a potential reversal opportunity. Trading volume remains substantial at nearly $80 million, indicating continued market interest despite the price decline. The elevated volatility of 9.55% reflects the current uncertainty in the market. For traders, this presents a potential accumulation zone for those with higher risk tolerance, though strict stop-losses below $85 are advisable. The convergence of technical indicators suggests we may be nearing a local bottom, but confirmation through price action above the 20-day SMA is needed before considering more aggressive long positions.

Key Metrics

| Price | 88.4700 USDT |

| 24h Change | -7.41% |

| 24h Volume | 79580035.11 |

| RSI(14) | 31.40 |

| SMA20 / SMA50 | 91.95 / 94.19 |

| Daily Volatility | 9.55% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).