Sentiment: Bearish

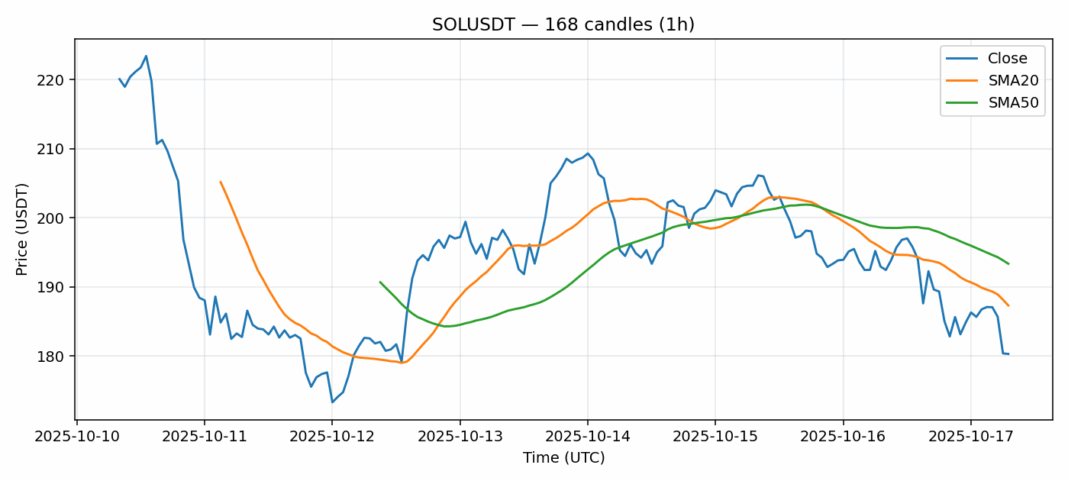

SOL is showing significant technical weakness as it trades at $180.28, down 7.67% over the past 24 hours. The current price sits below both the 20-day SMA ($187.32) and 50-day SMA ($193.36), indicating sustained bearish momentum. However, the RSI reading of 30.68 suggests the asset is approaching oversold territory, which could signal a potential near-term bounce. Trading volume remains robust at over $1.1 billion, indicating continued institutional interest despite the price decline. The elevated volatility of 6% presents both risk and opportunity for traders. For short-term positions, consider scaling into long positions around the $175-178 support zone with tight stops. Medium-term traders should wait for a confirmed break above the 20-day SMA before adding exposure. Given the oversold conditions, aggressive traders might find value in counter-trend plays, but risk management remains paramount in this volatile environment.

Key Metrics

| Price | 180.2800 USDT |

| 24h Change | -7.67% |

| 24h Volume | 1101491961.75 |

| RSI(14) | 30.68 |

| SMA20 / SMA50 | 187.32 / 193.36 |

| Daily Volatility | 6.03% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).