Sentiment: Bullish

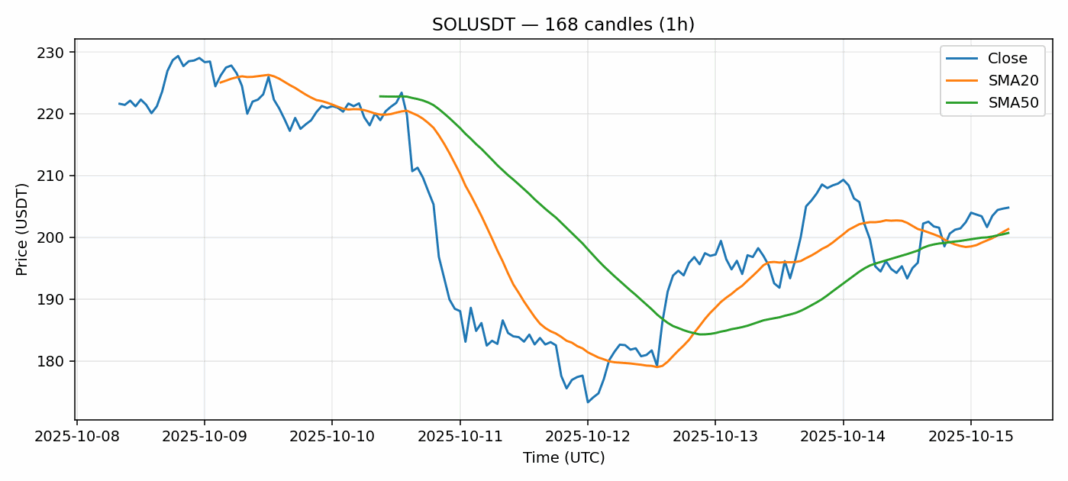

SOL is showing robust momentum, trading at $204.79 with a solid 4.44% gain over the past 24 hours. The current price sits above both the 20-day SMA ($201.33) and 50-day SMA ($200.70), indicating underlying strength and potential continuation of the uptrend. RSI at 60.75 suggests healthy bullish momentum without entering overbought territory, while elevated volatility of 5.68% presents both opportunity and risk. The substantial $1.22 billion 24-hour trading volume confirms strong institutional and retail interest. Traders should consider buying on dips toward the $201-202 support zone with stops below $198. Resistance appears near $208-210, where profit-taking may emerge. Given the technical alignment and momentum, SOL appears positioned for further gains, though the high volatility warrants careful position sizing.

Key Metrics

| Price | 204.7900 USDT |

| 24h Change | 4.44% |

| 24h Volume | 1220153950.84 |

| RSI(14) | 60.75 |

| SMA20 / SMA50 | 201.33 / 200.70 |

| Daily Volatility | 5.68% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).