Sentiment: Bullish

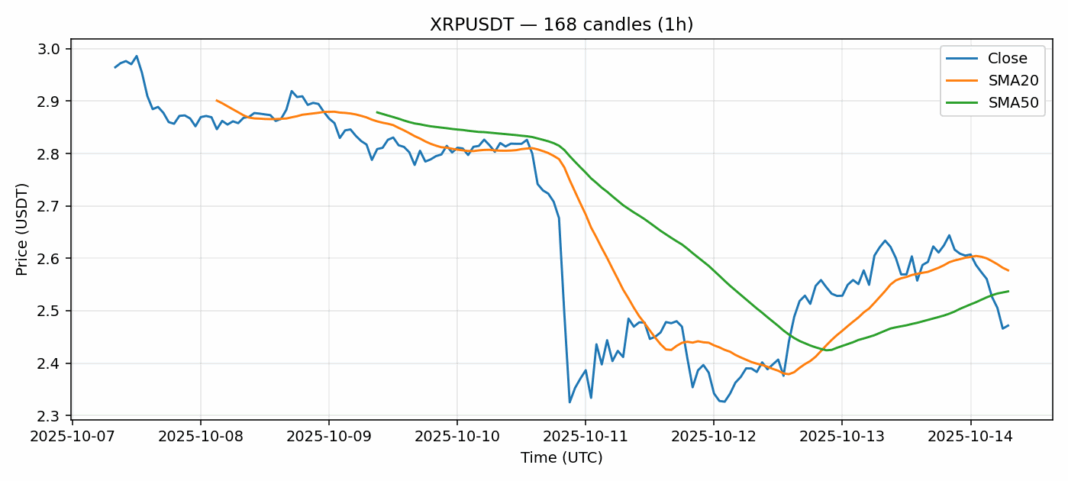

XRP is showing significant technical distress as it trades at $2.47, down over 5% in the past 24 hours. The most alarming signal comes from the RSI reading of 17.53, indicating severely oversold conditions that haven’t been seen in recent memory. While price sits below both the 20-day SMA ($2.58) and 50-day SMA ($2.54), suggesting continued bearish momentum, the extreme RSI levels typically precede a technical bounce. Trading volume remains substantial at $592 million, showing continued market interest despite the price decline. For traders, this presents a classic contrarian opportunity – consider scaling into long positions with tight stop losses below $2.40. The risk-reward ratio favors buyers at these levels, but given the 5.8% volatility, position sizing should be conservative. Watch for a break above the 20-day SMA as confirmation of a reversal.

Key Metrics

| Price | 2.4713 USDT |

| 24h Change | -5.34% |

| 24h Volume | 592069721.42 |

| RSI(14) | 17.53 |

| SMA20 / SMA50 | 2.58 / 2.54 |

| Daily Volatility | 5.84% |

Ripple — 1h candles, 7D window (SMA20/SMA50, RSI).