Sentiment: Bullish

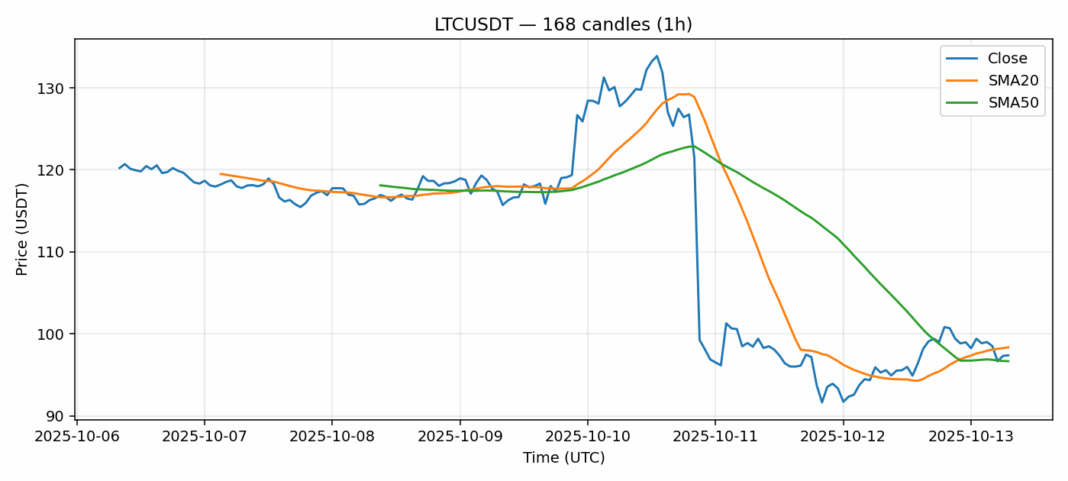

Litecoin is showing intriguing technical signals at the current $97.39 level. The 1.62% gain over the past 24 hours comes amid substantial trading volume exceeding $135 million, suggesting genuine institutional interest rather than retail speculation. The RSI reading of 39.92 indicates LTC is approaching oversold territory, potentially setting up for a reversal. Currently trading below the 20-day SMA at $98.36 but above the 50-day SMA at $96.67, LTC appears to be consolidating within a tight range. The elevated 9.54% volatility suggests we could see significant price movement in either direction. For traders, consider accumulating positions between $95-97 with tight stop losses around $94. A decisive break above $100 could trigger momentum buying toward $105 resistance. However, failure to hold the 50-day SMA support would likely push prices toward the $92-94 zone. Given the oversold RSI and strong volume profile, the risk-reward appears favorable for long positions with proper risk management.

Key Metrics

| Price | 97.3900 USDT |

| 24h Change | 1.62% |

| 24h Volume | 135577293.37 |

| RSI(14) | 39.92 |

| SMA20 / SMA50 | 98.36 / 96.67 |

| Daily Volatility | 9.54% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).