Sentiment: Bullish

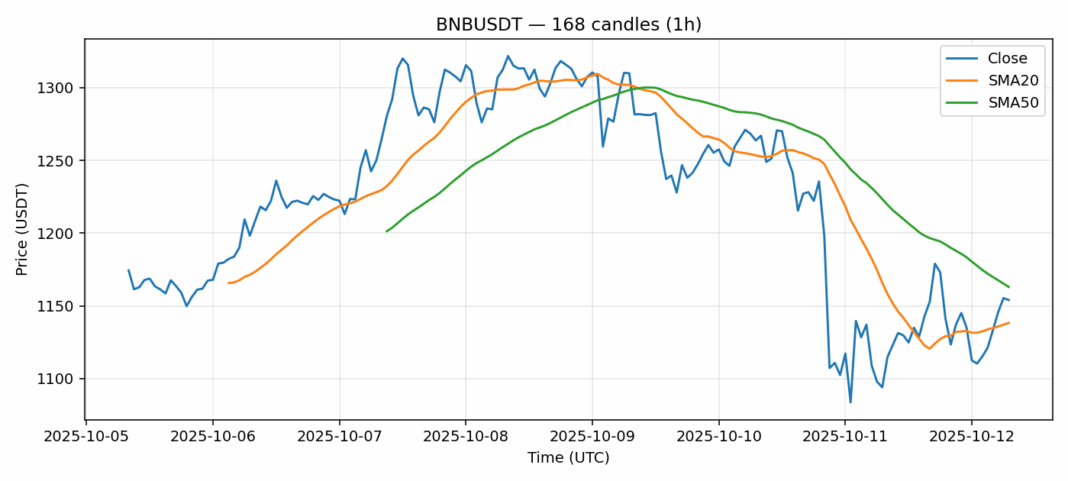

BNB is showing resilience at the $1,154 level despite broader market uncertainty, posting a solid 5.4% gain over the past 24 hours. The current price sits above the 20-day SMA at $1,138 but remains below the 50-day SMA at $1,163, indicating potential resistance ahead. With an RSI of 42, BNB is approaching oversold territory, suggesting limited downside from current levels. The substantial $856 million trading volume confirms strong institutional interest, while moderate volatility around 6% provides reasonable trading ranges. Traders should watch for a decisive break above the $1,163 resistance level for potential momentum toward $1,200. Support holds firm at $1,130-$1,140, making current levels attractive for accumulation. Consider scaling into positions with stops below $1,125, targeting $1,180-$1,200 for profit-taking. The volume profile suggests accumulation is underway, positioning BNB for potential upward movement if broader market conditions stabilize.

Key Metrics

| Price | 1154.1000 USDT |

| 24h Change | 5.40% |

| 24h Volume | 856270051.01 |

| RSI(14) | 42.12 |

| SMA20 / SMA50 | 1138.32 / 1163.08 |

| Daily Volatility | 6.05% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).