Sentiment: Neutral

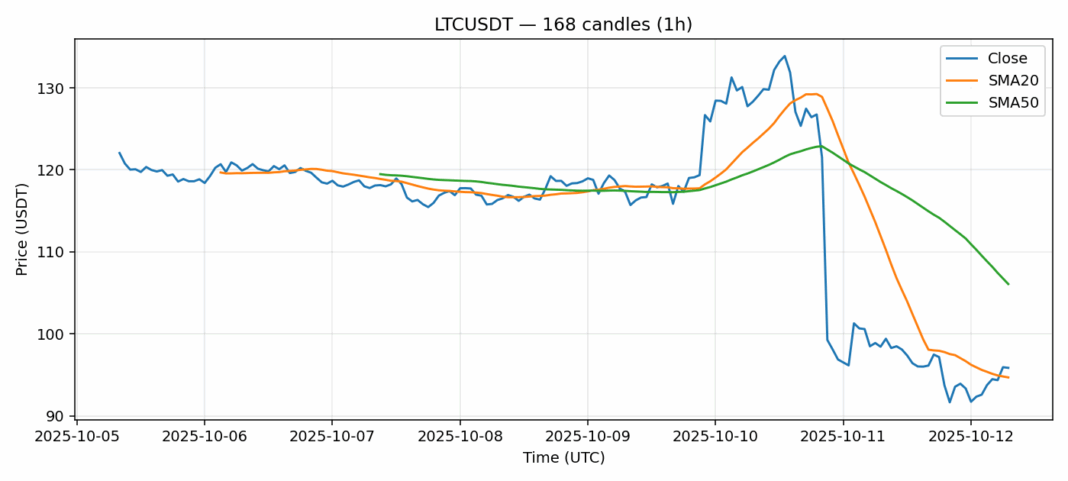

LTCUSDT is showing signs of consolidation after a challenging period, currently trading at $95.81 with a 3.15% decline over the past 24 hours. The RSI reading of 44.53 indicates neither overbought nor oversold conditions, suggesting room for movement in either direction. Notably, the price remains marginally above the 20-day SMA at $94.70 but significantly below the 50-day SMA at $106.08, highlighting persistent medium-term bearish pressure. Trading volume of $142 million demonstrates healthy market participation, while volatility at 9.4% suggests moderate price swings are likely. For traders, consider accumulating near the $94 support level with tight stop-losses, as a break below could trigger further declines toward $90. Resistance sits firmly at the $100 psychological level, and any sustained move above this could signal a potential reversal. Position sizing should remain conservative given the current technical setup.

Key Metrics

| Price | 95.8100 USDT |

| 24h Change | -3.15% |

| 24h Volume | 142416079.52 |

| RSI(14) | 44.53 |

| SMA20 / SMA50 | 94.70 / 106.08 |

| Daily Volatility | 9.42% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).