Sentiment: Bearish

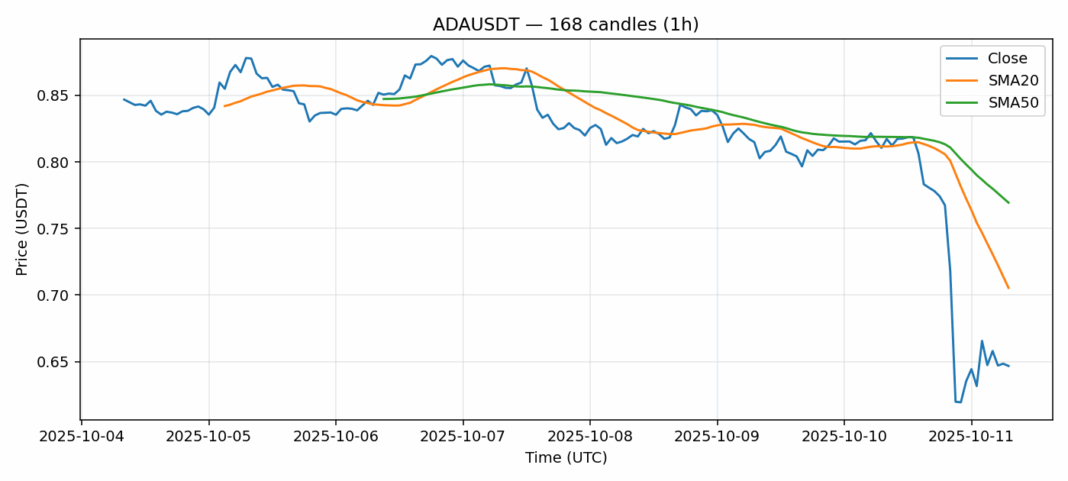

Cardano (ADA) is facing severe technical headwinds after a brutal 20.57% selloff pushed prices to $0.6467. The current RSI reading of 25.94 indicates deeply oversold conditions, typically preceding potential relief rallies. However, ADA remains trapped below both its 20-day SMA ($0.705) and 50-day SMA ($0.769), confirming the dominant bearish structure. Trading volume exceeding $624 million suggests capitulation-style selling, while elevated 7.48% volatility warns of continued turbulence. For traders, this presents a high-risk environment. Aggressive buyers might consider scaling into long positions near current levels with tight stops below $0.63, targeting a technical rebound toward $0.68-0.70 resistance. More conservative traders should wait for confirmed bullish reversal patterns or a break above the 20-day SMA before entering. Risk management remains paramount given the elevated volatility.

Key Metrics

| Price | 0.6467 USDT |

| 24h Change | -20.57% |

| 24h Volume | 624961708.66 |

| RSI(14) | 25.94 |

| SMA20 / SMA50 | 0.71 / 0.77 |

| Daily Volatility | 7.48% |

Cardano — 1h candles, 7D window (SMA20/SMA50, RSI).