Sentiment: Neutral

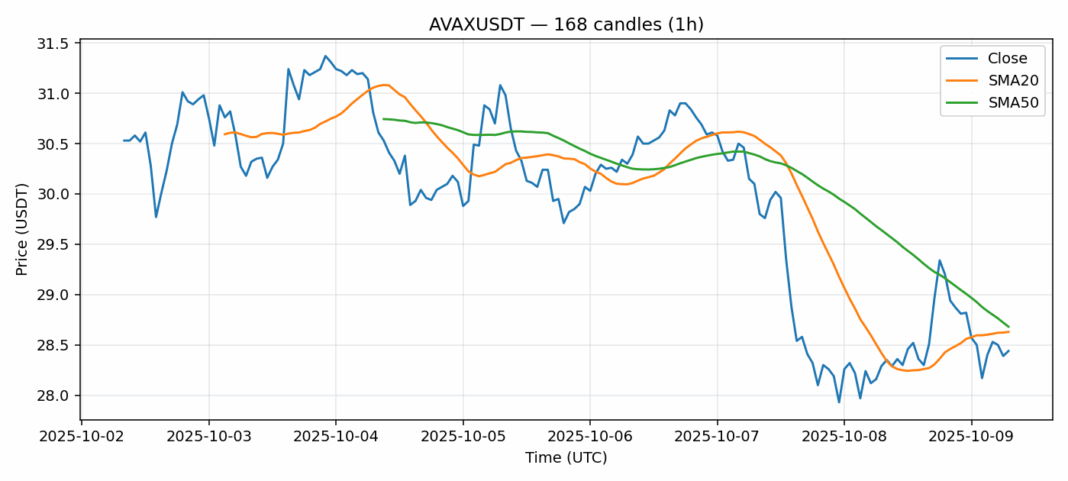

AVAX is showing intriguing technical signals as it trades at $28.44, slightly below both its 20-day ($28.63) and 50-day ($28.68) SMAs, indicating potential consolidation. The RSI reading of 37.7 places AVAX in oversold territory, suggesting limited downside momentum and possible accumulation opportunities. While the 24-hour change of 0.82% shows modest gains, the substantial $67.5 million trading volume indicates healthy market participation. Current volatility at 3.15% reflects typical crypto market conditions. Traders should watch for a decisive break above the $28.65-$28.70 SMA resistance zone, which could trigger momentum toward $30. Support appears firm around $27.50. Given the oversold RSI and proximity to key moving averages, consider scaling into long positions with stops below $27.20. The current setup favors range-bound trading with a slight bullish bias if volume persists.

Key Metrics

| Price | 28.4400 USDT |

| 24h Change | 0.81% |

| 24h Volume | 67492561.48 |

| RSI(14) | 37.74 |

| SMA20 / SMA50 | 28.63 / 28.68 |

| Daily Volatility | 3.15% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).