Sentiment: Bearish

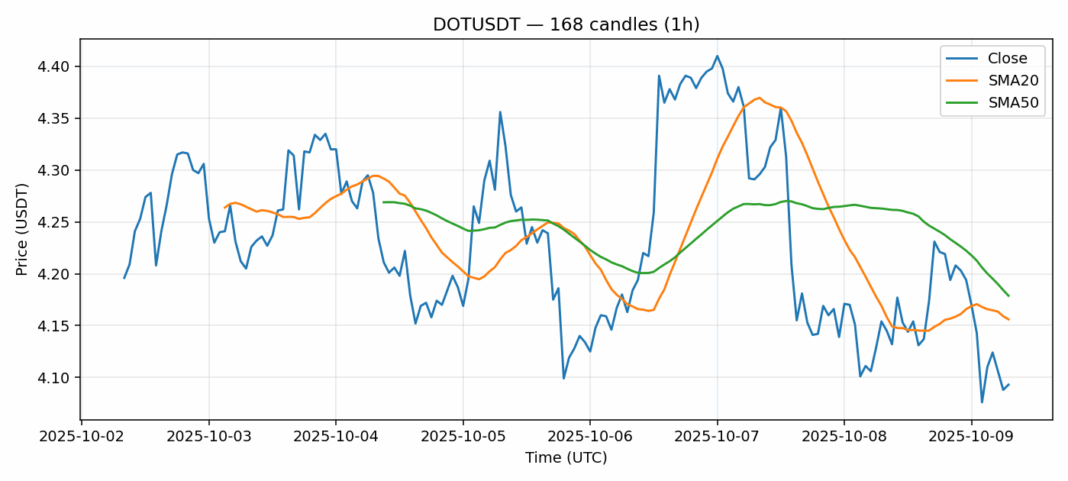

DOT faces significant selling pressure with a 0.94% decline over the past 24 hours, currently trading at $4.093 against USDT. The technical picture reveals concerning signals – the RSI reading of 24.63 indicates severely oversold conditions, typically suggesting potential for a short-term bounce. However, DOT continues trading below both its 20-day SMA ($4.156) and 50-day SMA ($4.178), confirming the bearish momentum remains intact. The elevated volatility reading of 3.38% reflects heightened market uncertainty. Volume remains substantial at nearly 27 million, suggesting institutional interest despite the price decline. For traders, consider waiting for RSI to recover above 30 before entering long positions. Downside support appears around the $4.00 psychological level, while resistance sits near the $4.16 SMA confluence. Risk management remains crucial given the current volatility environment.

Key Metrics

| Price | 4.0930 USDT |

| 24h Change | -0.94% |

| 24h Volume | 26979635.04 |

| RSI(14) | 24.63 |

| SMA20 / SMA50 | 4.16 / 4.18 |

| Daily Volatility | 3.38% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).