Sentiment: Bullish

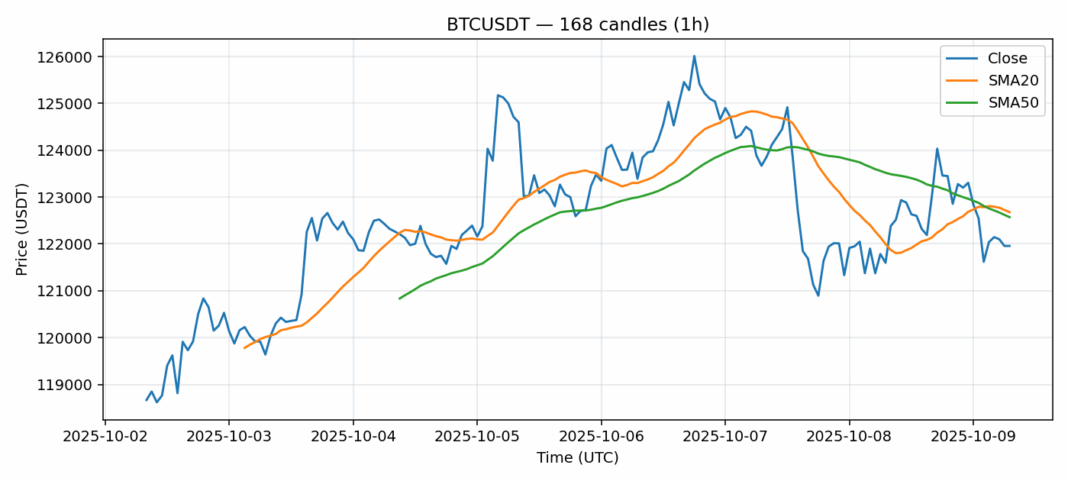

Bitcoin is currently trading at $121,957, showing modest 24-hour gains of 0.14% amid elevated volatility of 1.75%. The technical picture reveals interesting dynamics – BTC sits just below both its 20-day ($122,679) and 50-day ($122,571) SMAs, suggesting potential resistance overhead. However, the RSI reading of 25 indicates severely oversold conditions, typically preceding bullish reversals. The substantial $1.96 billion daily volume confirms active institutional participation at these levels. Traders should watch for a decisive break above the SMA confluence for confirmation of renewed upward momentum. Current positioning favors accumulation on dips, with tight stops below $120,000. The oversold RSI combined with strong volume support suggests the downside appears limited from here. Expect increased volatility as markets test these critical technical levels, but the risk-reward favors long positions for swing traders targeting a retest of $125,000 resistance.

Key Metrics

| Price | 121957.3300 USDT |

| 24h Change | 0.14% |

| 24h Volume | 1964830953.23 |

| RSI(14) | 25.18 |

| SMA20 / SMA50 | 122678.95 / 122570.88 |

| Daily Volatility | 1.75% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).