Sentiment: Neutral

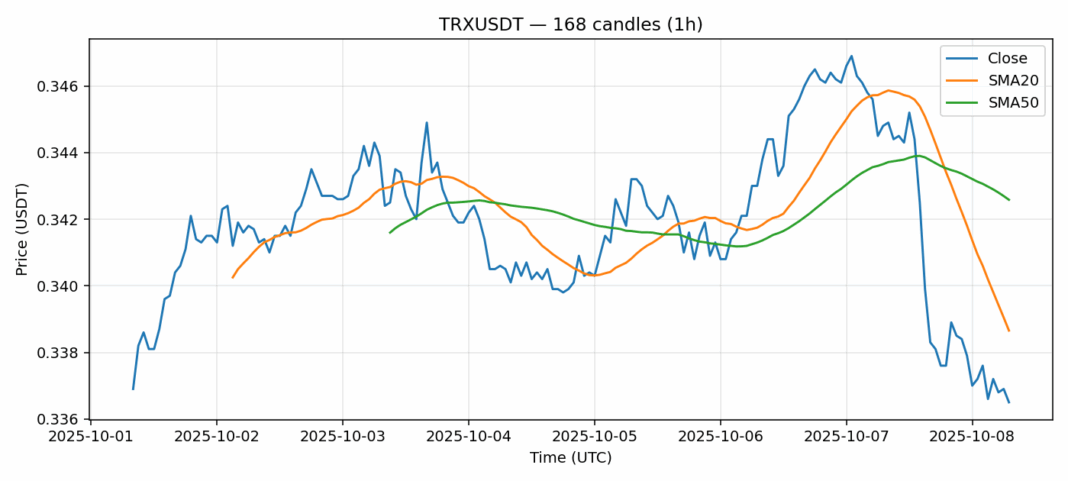

TRX is showing signs of consolidation after a 2.3% pullback over the past 24 hours, currently trading at $0.3365. The RSI reading of 38 indicates oversold conditions, suggesting potential for a near-term bounce. However, price remains below both the 20-day SMA ($0.3387) and 50-day SMA ($0.3426), indicating persistent bearish pressure in the medium term. Trading volume of $100 million remains healthy, providing adequate liquidity for position entries. The elevated volatility reading of 0.91 suggests traders should expect continued price swings. For active traders, consider scaling into long positions near current levels with tight stops below $0.33, targeting a retest of the 20-day SMA. Swing traders might wait for a confirmed break above the 20-day SMA before entering positions. Risk management remains crucial given the current market uncertainty.

Key Metrics

| Price | 0.3365 USDT |

| 24h Change | -2.29% |

| 24h Volume | 100557415.61 |

| RSI(14) | 38.24 |

| SMA20 / SMA50 | 0.34 / 0.34 |

| Daily Volatility | 0.91% |

TRON — 1h candles, 7D window (SMA20/SMA50, RSI).