Sentiment: Bearish

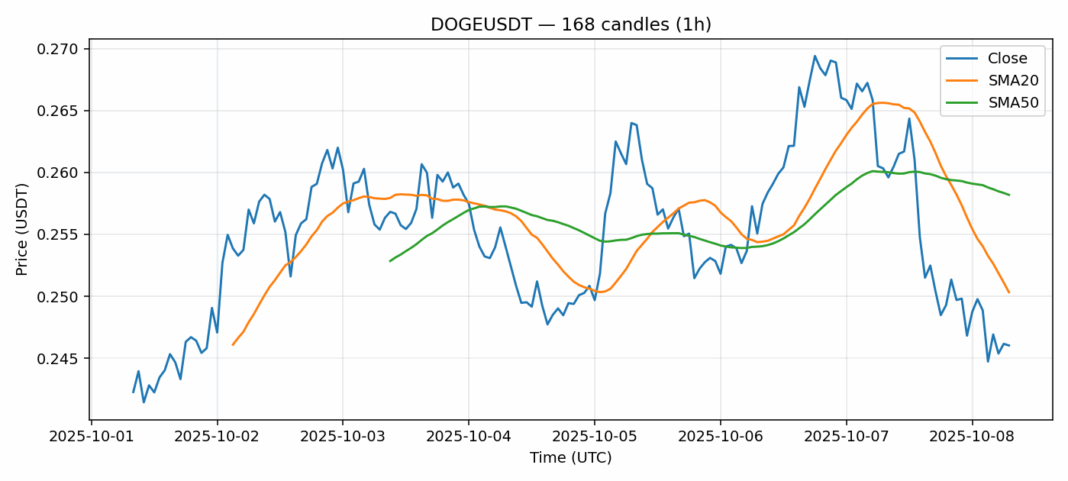

DOGE is showing concerning technical weakness as it trades at $0.246, down 5.7% over 24 hours and below both its 20-day SMA ($0.250) and 50-day SMA ($0.258). The RSI reading of 40 suggests the asset is approaching oversold territory but hasn’t reached extreme levels yet. While trading volume remains substantial at $468 million, the current price action indicates persistent selling pressure. The 3.64% volatility reading reflects typical DOGE market conditions but suggests traders should brace for potential sharp moves. Given the breakdown below key moving averages, I’d advise caution on long positions until we see a confirmed reversal pattern. Short-term traders might consider waiting for RSI to dip below 35 for potential bounce plays, while swing traders should monitor for a close back above the 20-day SMA as a potential bullish signal. Risk management remains crucial given DOGE’s historical volatility patterns.

Key Metrics

| Price | 0.2460 USDT |

| 24h Change | -5.69% |

| 24h Volume | 467851870.08 |

| RSI(14) | 40.16 |

| SMA20 / SMA50 | 0.25 / 0.26 |

| Daily Volatility | 3.64% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).