Sentiment: Bullish

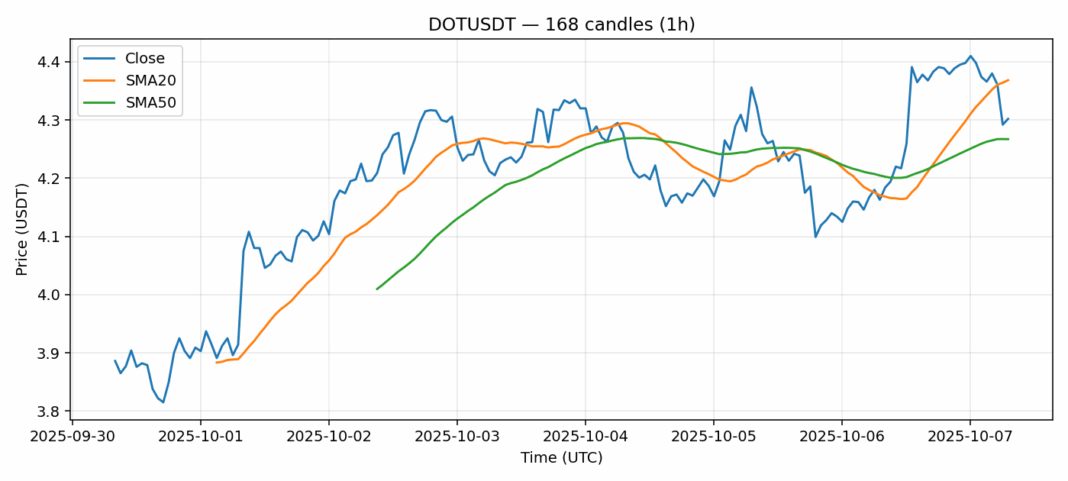

DOT is showing intriguing technical signals as it trades at $4.302, posting a respectable 2.85% gain over the past 24 hours. The current RSI reading of 30.43 indicates the asset is deeply oversold, suggesting potential for a near-term bounce. Price action finds DOT trading slightly below its 20-day SMA of $4.37 but above the 50-day SMA of $4.27, creating a technical tug-of-war between short-term resistance and medium-term support. The substantial $42 million trading volume confirms active institutional interest at these levels. Traders should watch for a decisive break above the $4.37 resistance, which could trigger momentum buying toward the $4.50 psychological level. Given the oversold conditions and positive volume profile, scaling into long positions with stops below $4.25 appears prudent for risk-managed entries. The relatively low volatility of 3.54% compared to typical crypto standards suggests accumulation may be underway.

Key Metrics

| Price | 4.3020 USDT |

| 24h Change | 2.85% |

| 24h Volume | 41995776.59 |

| RSI(14) | 30.43 |

| SMA20 / SMA50 | 4.37 / 4.27 |

| Daily Volatility | 3.54% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).