Sentiment: Bullish

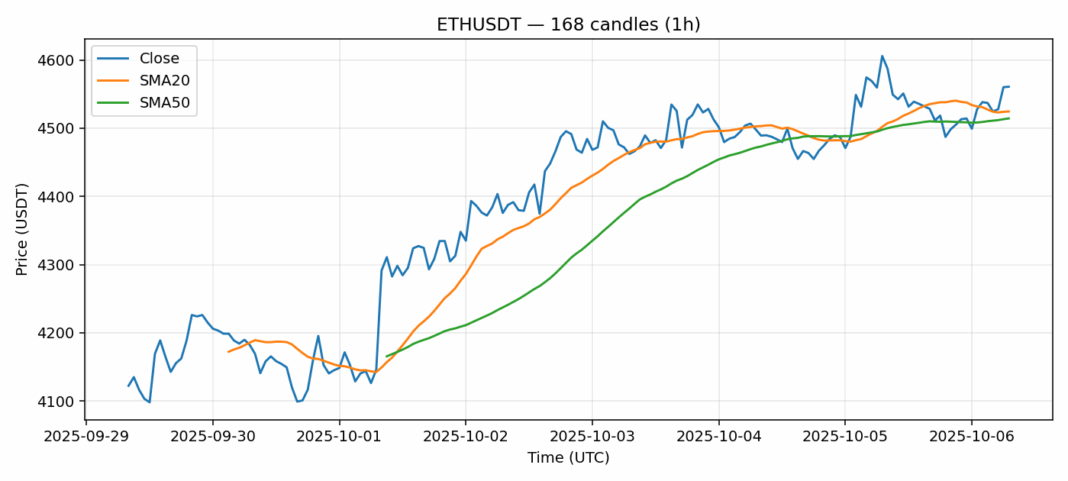

Ethereum continues to show strength as it trades at $4,560, maintaining its position above key moving averages. The 1.1% gain over the past 24 hours, coupled with substantial $1.89 billion trading volume, indicates sustained institutional interest. With ETH trading above both the 20-day SMA ($4,524) and 50-day SMA ($4,514), the technical setup remains constructive. The RSI reading of 64.5 suggests the asset is approaching overbought territory but still has room for further upside before reaching extreme levels. Current volatility at 2.6% reflects healthy market activity without excessive speculation. Traders should watch for a decisive break above $4,600, which could trigger momentum buying toward the $4,800 resistance zone. Consider accumulating on dips toward $4,500 support with tight stop-losses below $4,450. The overall structure favors continuation of the uptrend, though profit-taking near $4,700-$4,800 seems likely given the elevated RSI.

Key Metrics

| Price | 4560.9200 USDT |

| 24h Change | 0.01% |

| 24h Volume | 1892958116.61 |

| RSI(14) | 64.59 |

| SMA20 / SMA50 | 4524.60 / 4514.39 |

| Daily Volatility | 2.64% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).