Sentiment: Bullish

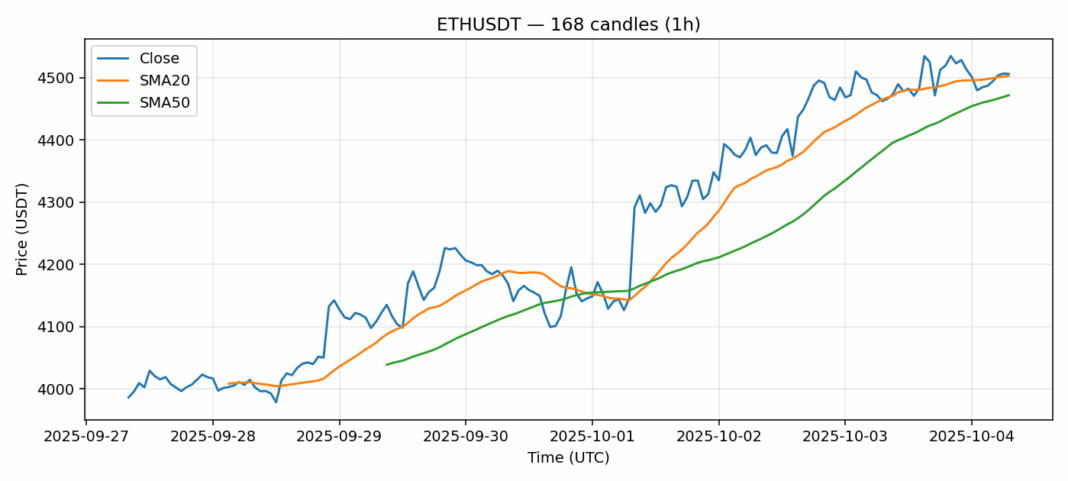

Ethereum continues to demonstrate resilience as it trades at $4,506, showing modest 0.8% gains over the past 24 hours. The current price sitting just above the 20-day SMA ($4,503) suggests underlying strength, while maintaining position well above the 50-day SMA ($4,472) indicates the medium-term uptrend remains intact. With RSI at 61, ETH approaches overbought territory but still has room for upward movement before hitting extreme levels. The $4,500 level appears to be acting as both support and psychological barrier – a sustained break above could trigger momentum towards $4,600. Trading volume remains healthy at $1.96B, supporting the current price action. Traders should watch for consolidation around current levels with stops below $4,450. Consider scaling into positions on pullbacks toward the 20-day SMA, while aggressive traders might look for breakout confirmation above $4,520 for short-term momentum plays. The volatility reading of 2.6% suggests typical market conditions for ETH.

Key Metrics

| Price | 4506.0000 USDT |

| 24h Change | 0.81% |

| 24h Volume | 1965743387.07 |

| RSI(14) | 60.94 |

| SMA20 / SMA50 | 4503.18 / 4471.77 |

| Daily Volatility | 2.60% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).