Sentiment: Neutral

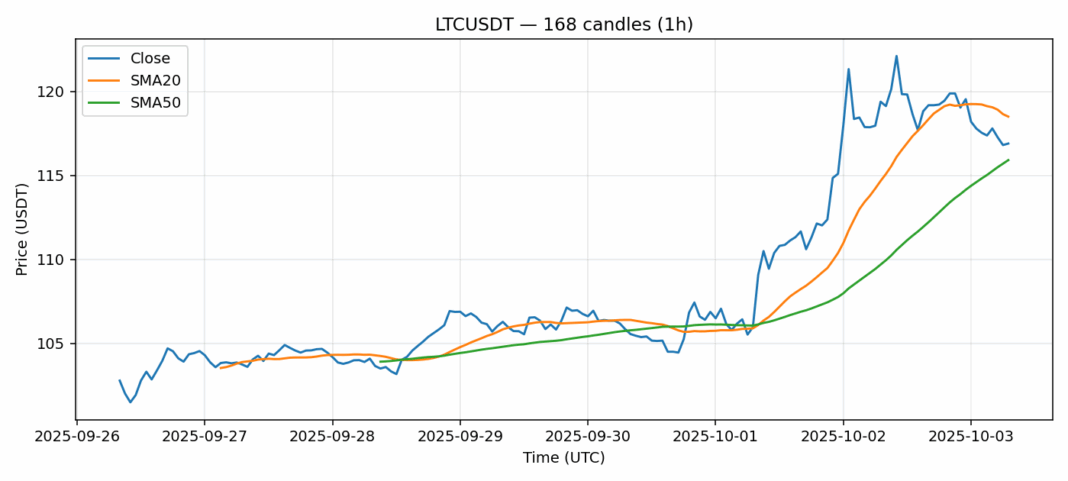

Litecoin is currently trading at $116.90, showing modest weakness with a 1.05% decline over the past 24 hours. The technical picture reveals interesting dynamics – while price sits below the 20-day SMA at $118.50, it remains above the 50-day SMA at $115.91, suggesting near-term consolidation. The RSI reading of 30 indicates LTC is approaching oversold territory, which historically presents potential buying opportunities for swing traders. Daily volume of $101.8 million demonstrates healthy market participation despite the price dip. Current volatility of 3.17% suggests relatively stable conditions compared to typical crypto movements. For traders, the $115-116 zone appears critical as support, with a break below potentially testing the $112 level. Resistance sits firmly at the $119-120 range. Given the oversold RSI and proximity to key moving averages, accumulation on dips toward $115 seems prudent for medium-term positions. Risk management remains essential with stop losses below $114.

Key Metrics

| Price | 116.9000 USDT |

| 24h Change | -1.05% |

| 24h Volume | 101800157.93 |

| RSI(14) | 30.00 |

| SMA20 / SMA50 | 118.50 / 115.91 |

| Daily Volatility | 3.17% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).