Sentiment: Neutral

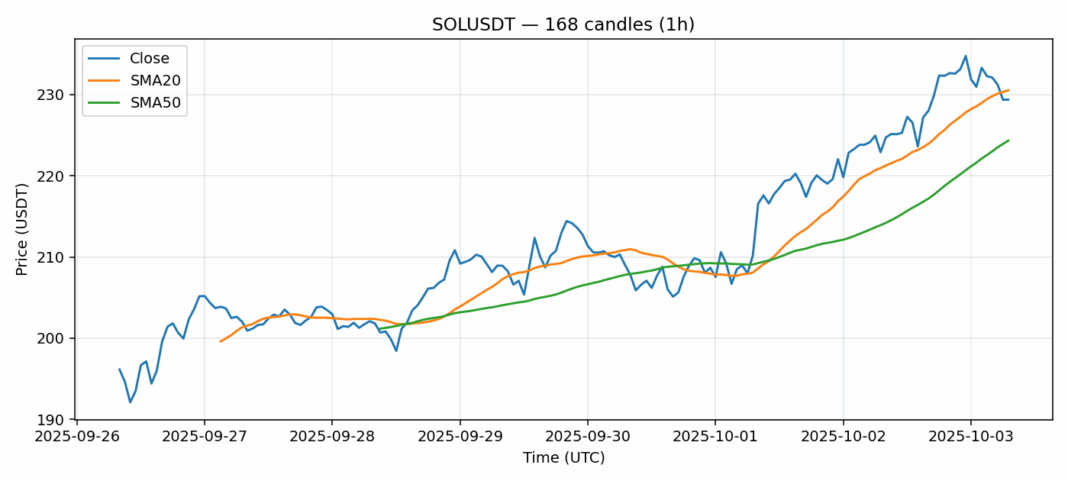

SOL is currently trading at $229.38, showing modest gains of 2.07% over the past 24 hours. The price action finds SOL hovering just below its 20-day SMA of $230.52 while maintaining a comfortable position above the 50-day SMA of $224.33. This technical setup suggests consolidation within a defined range. The RSI reading of 48.52 indicates neutral momentum, neither overbought nor oversold, providing room for movement in either direction. Trading volume remains robust at $948 million, signaling sustained market interest. Given the current technical positioning, traders might consider accumulating on dips toward the $224 support level with tight stop losses. Resistance around $232-235 could present profit-taking opportunities. The moderate volatility of 3.37% suggests controlled price movements rather than erratic swings, offering favorable conditions for strategic position building. Monitor Bitcoin’s broader market direction for potential correlation effects.

Key Metrics

| Price | 229.3800 USDT |

| 24h Change | 2.07% |

| 24h Volume | 948031365.70 |

| RSI(14) | 48.52 |

| SMA20 / SMA50 | 230.52 / 224.33 |

| Daily Volatility | 3.37% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).