In a significant policy shift, Democratic lawmakers in New York are advancing proposals to impose higher tax burdens on cryptocurrency mining enterprises. The legislative initiative targets Bitcoin mining facilities specifically, citing substantial energy consumption as the primary justification for enhanced fiscal measures.

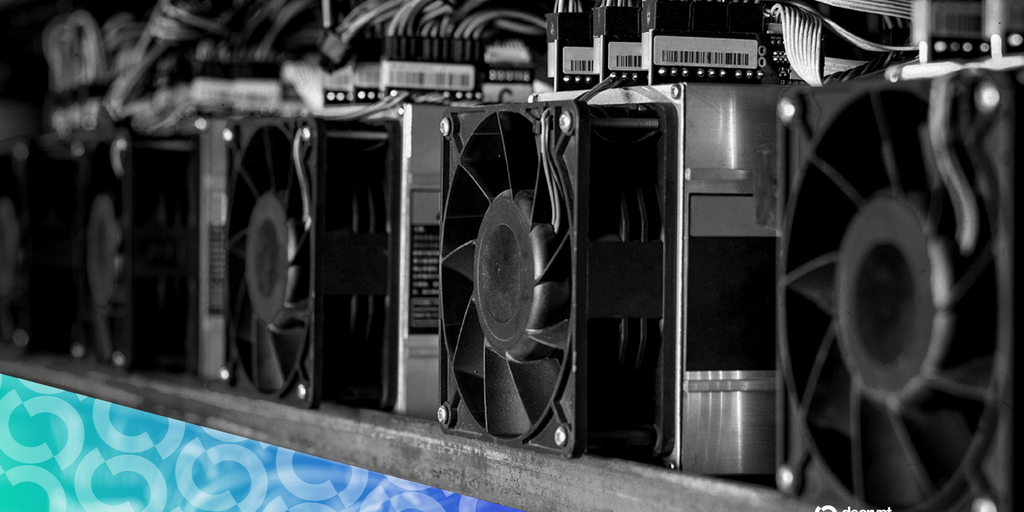

State representatives argue that the computational intensity required for proof-of-work validation necessitates extraordinary electricity usage, creating disproportionate strain on regional power infrastructure. The proposed taxation framework aims to address what legislators characterize as environmental externalities and infrastructure costs associated with industrial-scale mining operations.

Industry analysts note that New York hosts several major mining facilities attracted by the state’s historically competitive energy markets and cooling climate conditions. The proposed legislation would establish a tiered taxation system based on energy consumption metrics, potentially reshaping the economic viability of mining activities within state jurisdiction.

Proponents contend that the measure would generate substantial state revenue while encouraging more sustainable operational practices. Critics within the cryptocurrency sector warn that such targeted taxation could drive mining operations to more favorable regulatory environments, potentially reducing New York’s prominence in blockchain infrastructure development.

The proposal emerges amid broader national discussions about cryptocurrency regulation and follows previous state-level actions addressing environmental concerns related to digital asset mining operations.