The cryptocurrency mining industry witnessed a historic surge in market capitalization during September, with publicly-traded Bitcoin mining enterprises collectively reaching record-breaking valuations. This remarkable growth trajectory reflects renewed investor confidence in the sector’s long-term profitability and strategic positioning within the digital asset ecosystem.

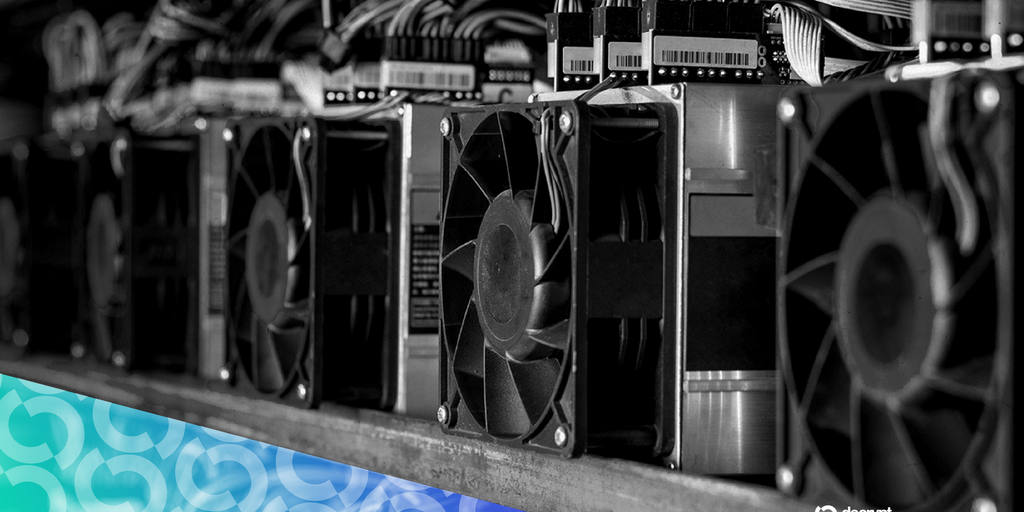

Analysts attribute this substantial market cap expansion to several key factors, including improved operational efficiencies, enhanced mining infrastructure, and favorable market conditions for digital assets. The sector’s performance significantly outpaced broader cryptocurrency market trends, indicating specialized investor interest in mining-specific equities.

Concurrently, industry observers note that numerous mining corporations have been strategically reallocating resources toward advanced computational operations. This strategic pivot includes diversifying into high-performance computing applications beyond traditional cryptocurrency validation, positioning these firms to capitalize on emerging technological opportunities while maintaining their core Bitcoin mining operations.

The convergence of these developments suggests a maturing industry that’s increasingly integrating with mainstream financial markets while simultaneously exploring innovative revenue streams. Market participants continue to monitor how these strategic shifts will impact both the mining sector’s profitability and the broader Bitcoin network’s security and decentralization in the coming quarters.