Sentiment: Neutral

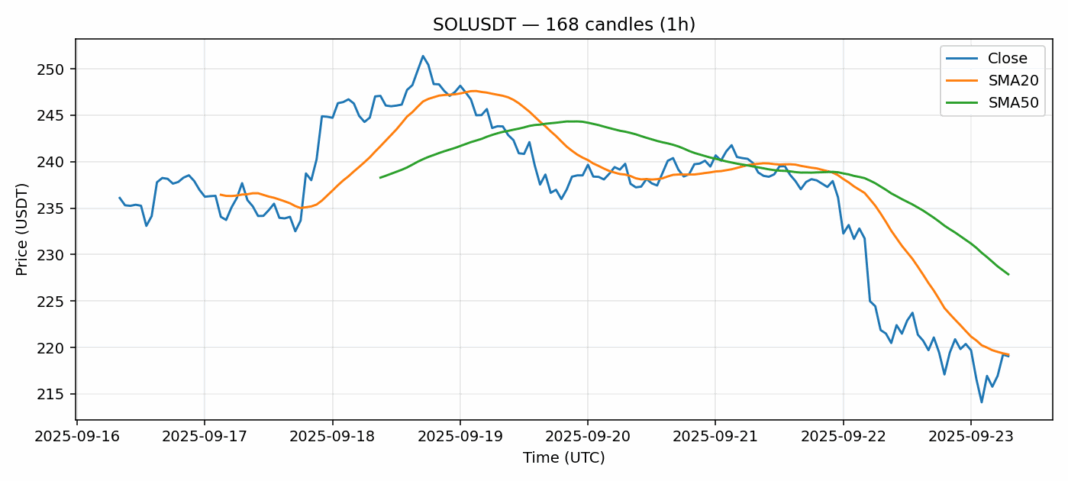

SOL is currently trading at $219.07, showing slight weakness with a 2.19% decline over the past 24 hours. The price is hovering just below the 20-day SMA ($219.25) while remaining significantly below the 50-day SMA ($227.88), indicating near-term consolidation within a broader downtrend. The RSI reading of 45.68 suggests neutral momentum with a slight bearish bias, though not yet oversold. Trading volume remains robust at over $1 billion, showing continued institutional interest despite the price pressure. Volatility sits at 2.95%, reflecting typical crypto market conditions. Key support lies around $215, with resistance near the 50-day SMA. Traders should consider scaling into long positions near support levels with tight stops, while aggressive traders might short bounces toward the 50-day SMA. The market structure suggests accumulation phase characteristics, but confirmation requires a break above $230.

Key Metrics

| Price | 219.0700 USDT |

| 24h Change | -2.19% |

| 24h Volume | 1009098647.81 |

| RSI(14) | 45.68 |

| SMA20 / SMA50 | 219.25 / 227.88 |

| Daily Volatility | 2.95% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).