Sentiment: Bearish

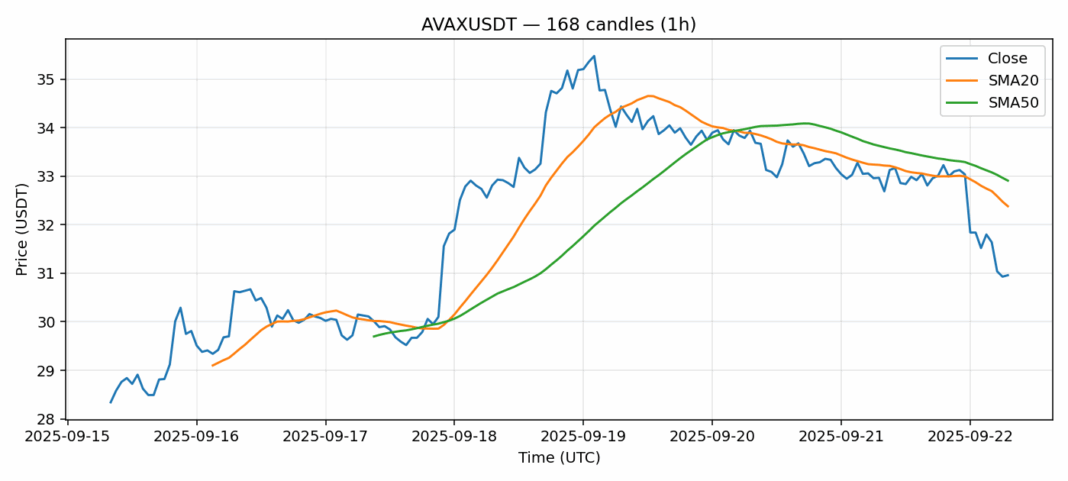

AVAX is showing significant weakness, trading at $30.95 with a sharp 6.13% decline over the past 24 hours. The RSI reading of 20.76 indicates severely oversold conditions, typically suggesting potential for a short-term bounce. However, the price remains below both the 20-day SMA ($32.38) and 50-day SMA ($32.91), confirming the bearish momentum. Volume remains elevated at $140M, indicating active selling pressure. Given the high volatility of 4.46%, traders should exercise caution. I’d recommend waiting for RSI to recover above 30 before considering long positions. Short-term traders might look for a bounce from these oversold levels, but any rally should be treated as corrective rather than trend-changing. Set tight stops if attempting to catch the falling knife.

Key Metrics

| Price | 30.9500 USDT |

| 24h Change | -6.13% |

| 24h Volume | 140218380.48 |

| RSI(14) | 20.76 |

| SMA20 / SMA50 | 32.38 / 32.91 |

| Daily Volatility | 4.46% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).