Sentiment: Neutral

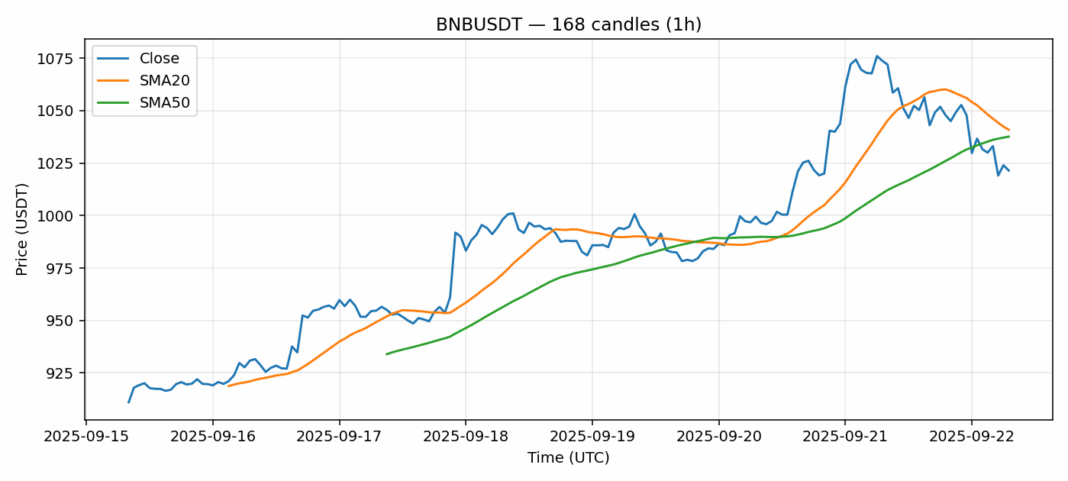

BNB is currently trading at $1021.44, showing a notable 24-hour decline of -5.01% amid elevated volatility of 2.66%. The RSI reading of 32.37 indicates oversold conditions, suggesting potential for a near-term bounce. Price is trading below both the 20-day SMA ($1040.87) and 50-day SMA ($1037.61), confirming short-term bearish momentum. However, the proximity to these moving averages suggests we’re approaching a critical support zone. Volume remains substantial at over $502 million, indicating active participation. My advice would be to watch for a potential reversal around the $1015-$1020 level. Consider scaling into long positions if RSI begins to recover above 35, with stops below $1000. Alternatively, wait for a clear break above the 20-day SMA before adding exposure.

Key Metrics

| Price | 1021.4400 USDT |

| 24h Change | -5.01% |

| 24h Volume | 502656302.66 |

| RSI(14) | 32.37 |

| SMA20 / SMA50 | 1040.87 / 1037.61 |

| Daily Volatility | 2.66% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).