Sentiment: Bearish

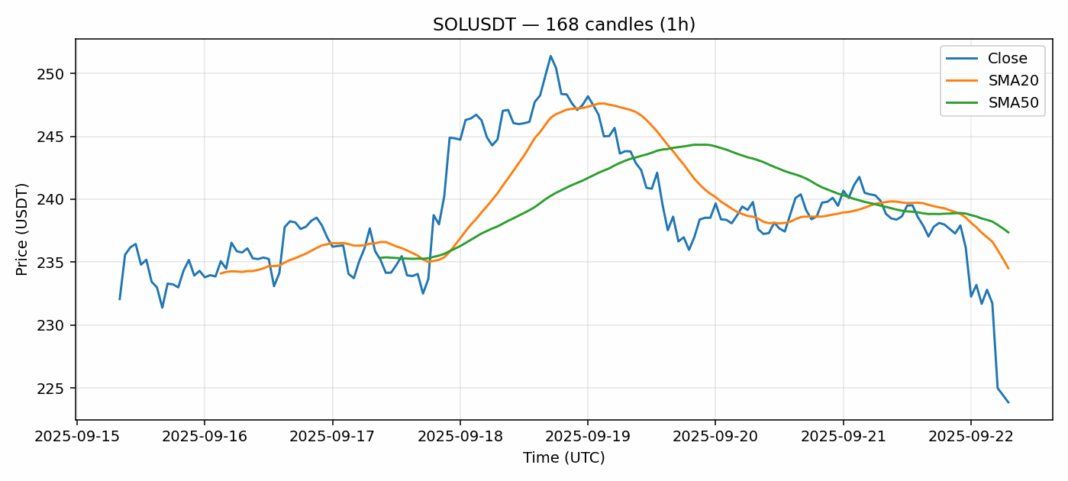

SOL is currently trading at $223.85, showing a notable 24-hour decline of -6.84%. The RSI reading of 14.97 indicates severely oversold conditions, suggesting potential for a short-term bounce. However, price remains below both the 20-day SMA ($234.52) and 50-day SMA ($237.37), confirming the bearish momentum. Volume remains elevated at $836M, indicating active participation in this move. Given the extreme oversold RSI and high volatility of 2.74%, I’d recommend caution for short positions here. Consider scaling into long positions with tight stops below $220 for a potential mean reversion play. Wait for RSI to recover above 30 before adding size. Risk management is crucial given the elevated volatility environment.

Key Metrics

| Price | 223.8500 USDT |

| 24h Change | -6.84% |

| 24h Volume | 836582047.91 |

| RSI(14) | 14.97 |

| SMA20 / SMA50 | 234.52 / 237.37 |

| Daily Volatility | 2.74% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).