Former BitMEX CEO Arthur Hayes has forecasted a significant bullish phase for cryptocurrency markets, contingent on the United States Treasury replenishing its General Account (TGA) to a target of $850 billion. According to Hayes, achieving this threshold will catalyze a substantial injection of liquidity into private financial markets, creating favorable conditions for risk assets, including digital currencies.

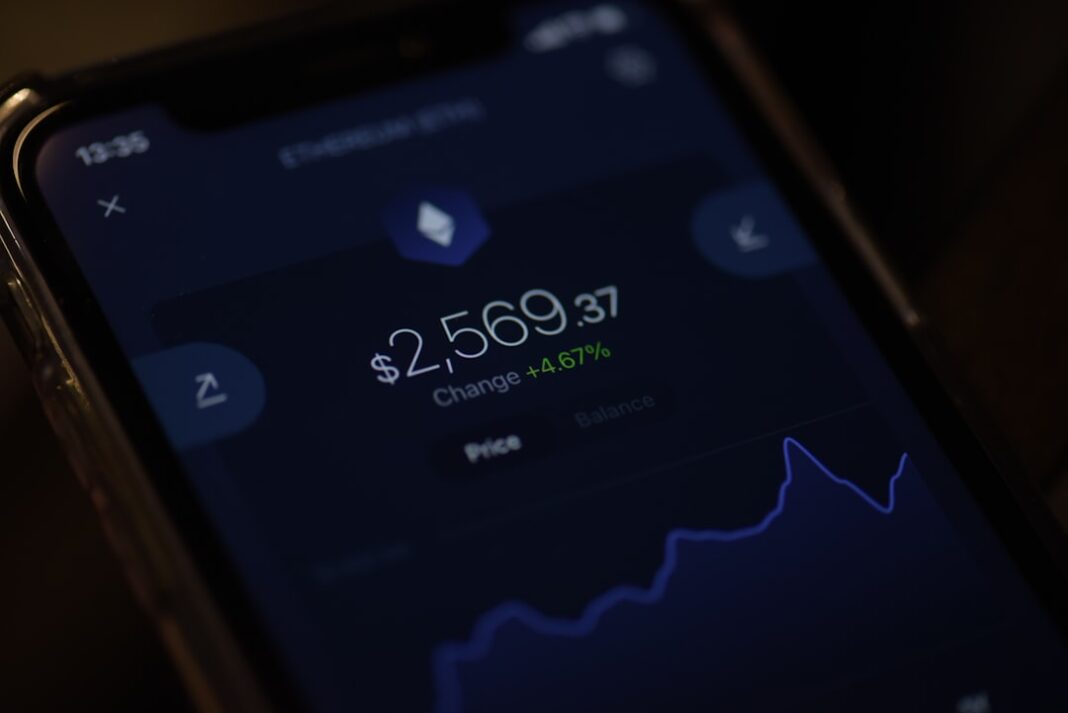

Hayes, a respected voice in the crypto space, argues that the refilling of the TGA—essentially the Treasury’s operating account—signals a shift in fiscal strategy that indirectly benefits speculative investments. As liquidity increases, investors are likely to seek higher returns in alternative assets, with cryptocurrencies positioned to capture significant capital inflows. This dynamic could propel major digital assets like Bitcoin and Ethereum into an upward trajectory, echoing past cycles where expansive fiscal measures preceded market rallies.

His analysis underscores the interconnectedness of macroeconomic policies and crypto performance, emphasizing that Treasury operations often serve as a precursor to market movements. While short-term volatility may persist, Hayes maintains that the structural liquidity shift will ultimately dominate, setting the stage for a sustained crypto advance. Market participants are advised to monitor TGA balance reports closely, as the $850 billion milestone approaches.