Sentiment: Bullish

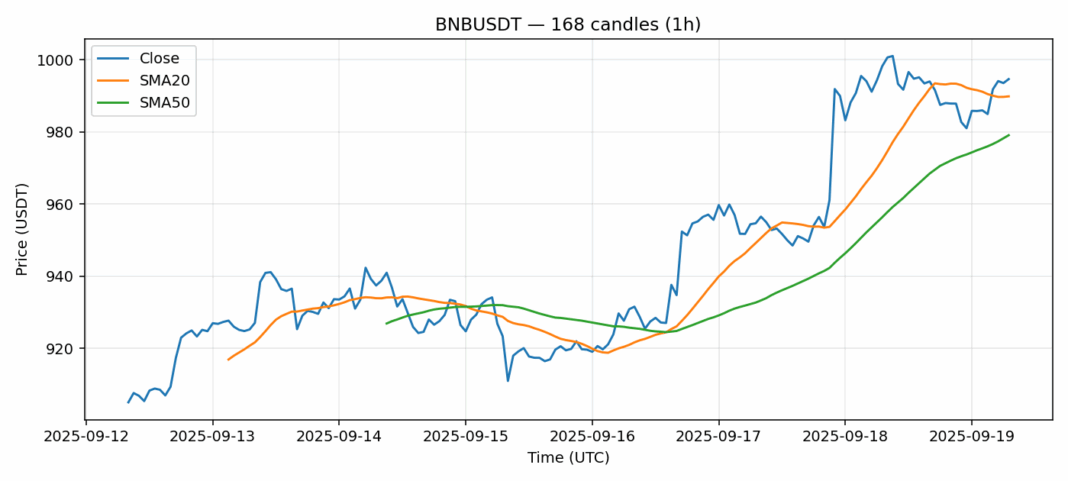

BNB is currently trading at $994.64, showing no change over the past 24 hours but holding above both the 20-day SMA ($989.87) and 50-day SMA ($979.10), indicating underlying strength. The RSI at 55.34 is neutral, suggesting neither overbought nor oversold conditions. Volume remains robust at over $386 million, supporting price stability. Volatility is moderate at 2.21%, typical for BNB’s recent behavior. Given the consolidation near key moving averages, I expect a potential breakout if buying pressure increases. Traders might consider accumulating on dips toward $980 with a stop-loss around $965, targeting a move toward $1,020. Keep an eye on broader market sentiment and Binance-related news, as these often drive BNB’s price action.

Key Metrics

| Price | 994.6400 USDT |

| 24h Change | 0.00% |

| 24h Volume | 386160130.36 |

| RSI(14) | 55.34 |

| SMA20 / SMA50 | 989.87 / 979.10 |

| Daily Volatility | 2.21% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).