Sentiment: Bullish

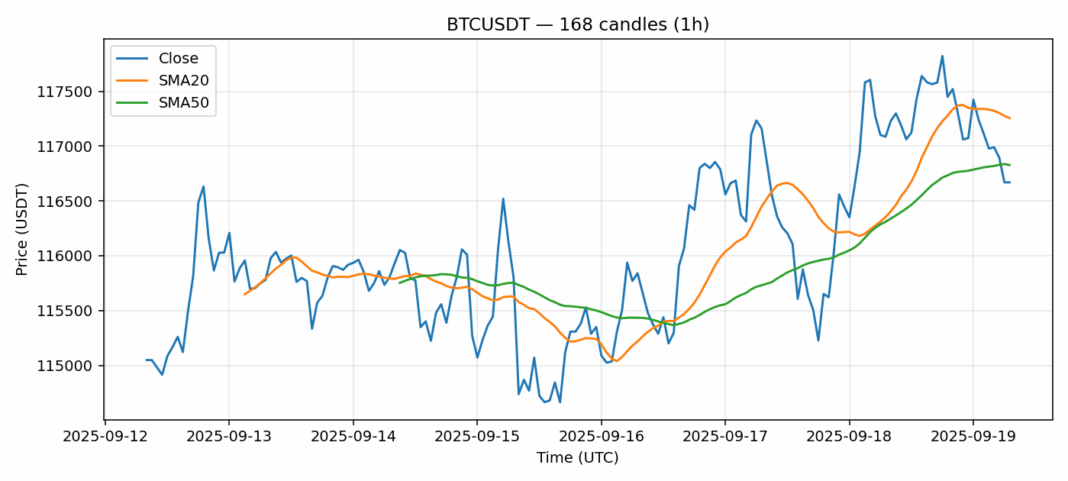

Bitcoin is currently trading at $116,669.75, showing a slight decline of 0.37% over the past 24 hours. The RSI reading of 30.13 indicates that BTC is in oversold territory, which historically presents potential buying opportunities. Price is trading slightly below both the 20-day SMA ($117,256.77) and 50-day SMA ($116,828.23), suggesting near-term bearish pressure but with strong support levels nearby. The 24-hour volume of $1.12 billion shows healthy market participation, while volatility remains moderate at 1.07%. Given the oversold conditions and proximity to key moving averages, I recommend accumulating positions on any dips toward $116,500. Set stop-losses below $115,800 and target resistance levels at $118,000 for short-term trades. The market structure suggests we’re in a consolidation phase before the next significant move.

Key Metrics

| Price | 116669.7500 USDT |

| 24h Change | -0.37% |

| 24h Volume | 1124757093.10 |

| RSI(14) | 30.13 |

| SMA20 / SMA50 | 117256.77 / 116828.23 |

| Daily Volatility | 1.07% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).