Sentiment: Bearish

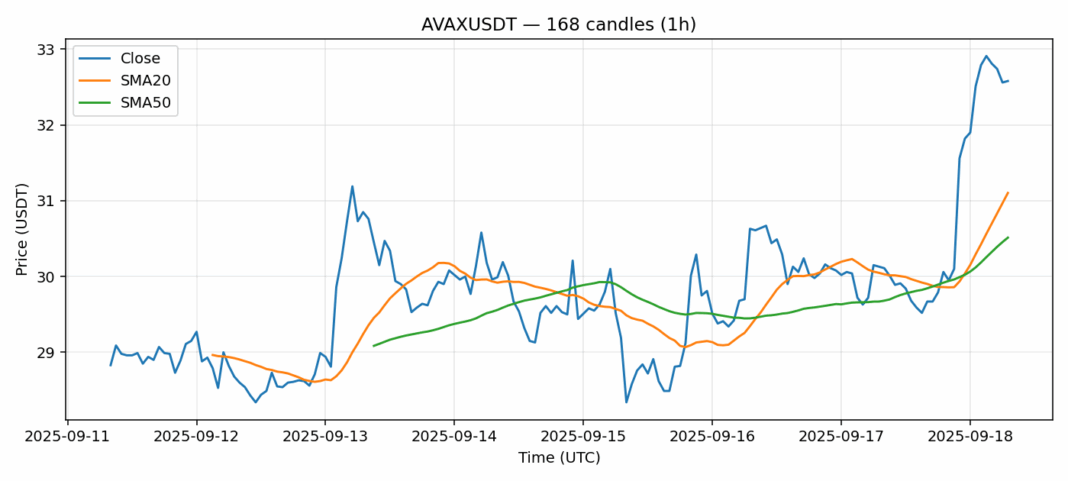

AVAX is showing strong momentum with an 8.42% surge in the past 24 hours, currently trading at $32.58. The price is positioned above both the 20-day SMA ($31.10) and 50-day SMA ($30.51), indicating a bullish trend structure. However, the extremely high RSI reading of 88 suggests the asset is severely overbought and due for a pullback. The elevated volatility of 4.64% confirms heightened market activity. Trading volume of over $203M provides solid confirmation of this move. My advice: wait for a retracement to the $30-31 support zone before considering long entries. Current levels present significant risk for new positions. Set tight stops if trading against this momentum.

Key Metrics

| Price | 32.5800 USDT |

| 24h Change | 8.42% |

| 24h Volume | 203494672.96 |

| RSI(14) | 87.99 |

| SMA20 / SMA50 | 31.10 / 30.51 |

| Daily Volatility | 4.64% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).