Sentiment: Neutral

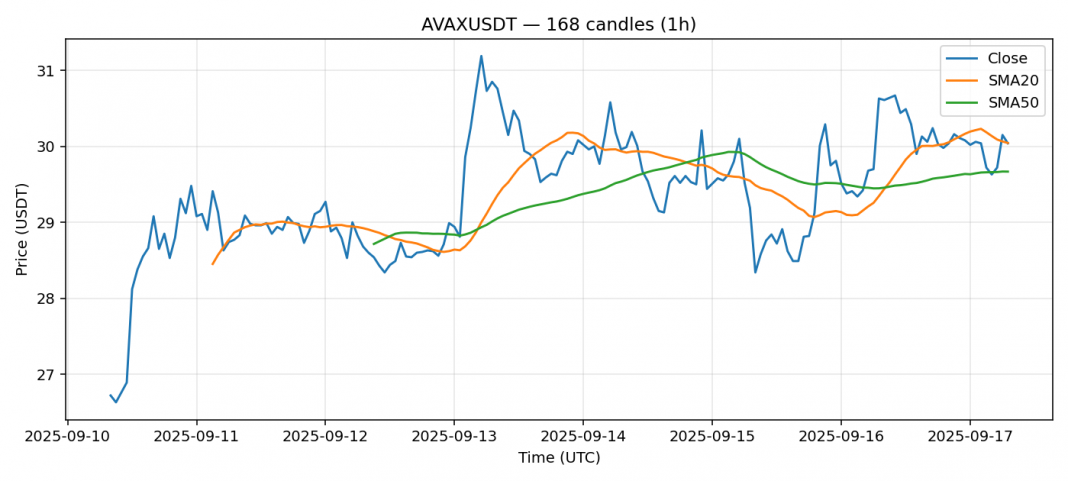

AVAX is showing mixed signals at $30.04, trading essentially at its 20-day SMA of $30.04, which indicates a critical inflection point. The 24-hour change of +0.70% is modestly positive, but the RSI at 44 suggests the asset is neither overbought nor oversold, leaning slightly bearish. Volume of $122M is healthy, providing decent liquidity, while volatility of 4.84% is moderate for crypto, typical for consolidation phases. The price hovering near the 20-day SMA and above the 50-day SMA at $29.67 hints at underlying support, but lacks strong momentum. Traders should watch for a break above $30.50 for bullish confirmation, or a drop below $29.50 could signal further downside. Consider setting tight stop-losses around $29.20 if long, and wait for clearer directional moves before adding significant positions.

Key Metrics

| Price | 30.0400 USDT |

| 24h Change | 0.70% |

| 24h Volume | 122246390.31 |

| RSI(14) | 44.05 |

| SMA20 / SMA50 | 30.04 / 29.67 |

| Daily Volatility | 4.84% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).